Ichimoku analysis (Hourly chart)

Tenken-Sen- $1735.31

Kijun-Sen- $1723.97

Gold is consolidating after hitting a multi-month low of around $1707. The vaccine optimism and hopes of more fiscal stimulus have decreased the demand for safe-haven assets. The US 10- year yield declined after hitting a multi-month high. US dollar index halted its four days of the bullish trend and lost more than 50 pips.

Economic data:

Market eyes US ADP employment and ISM Services PMI for further direction.

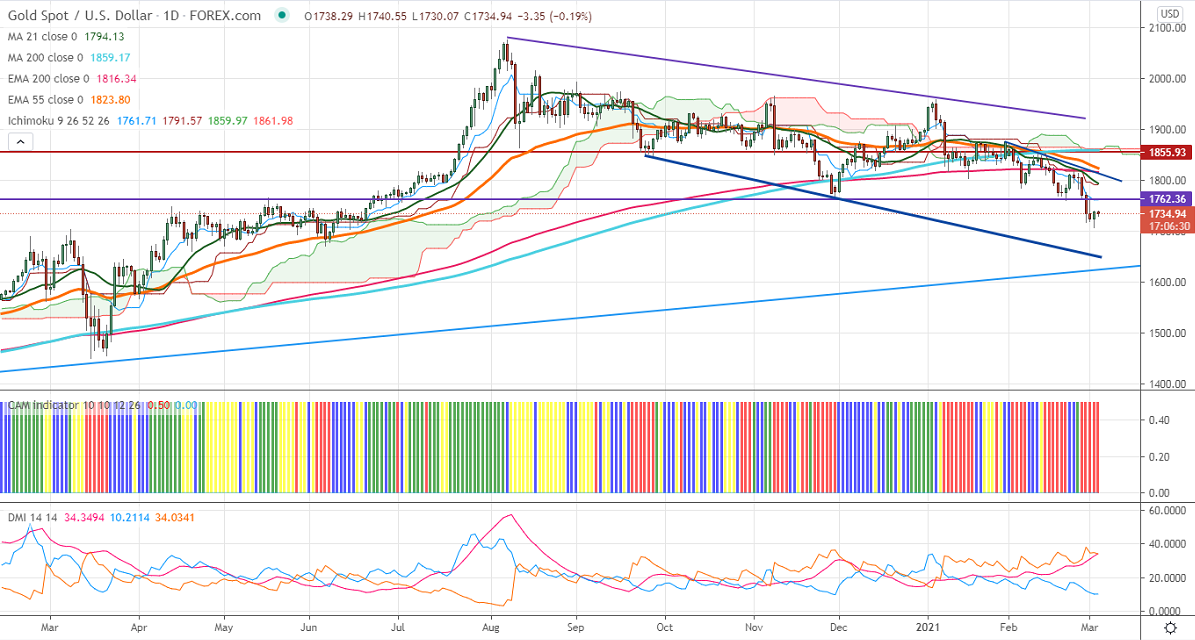

Technical:

It is facing strong support at $1720, violation below targets $1700/$1660/$1637. On the higher side, near-term resistance is around $1745, any indicative break above that level will take till $1760/$1779/$1800.

It is good to sell on rallies around $1728-30 with SL around $1750 for the TP of $1650.