Traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatility strategy. The implied volatility of 1M ATM AUDJPY put contract is at 14.09% and it is quite higher side which is good sign for option writers.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

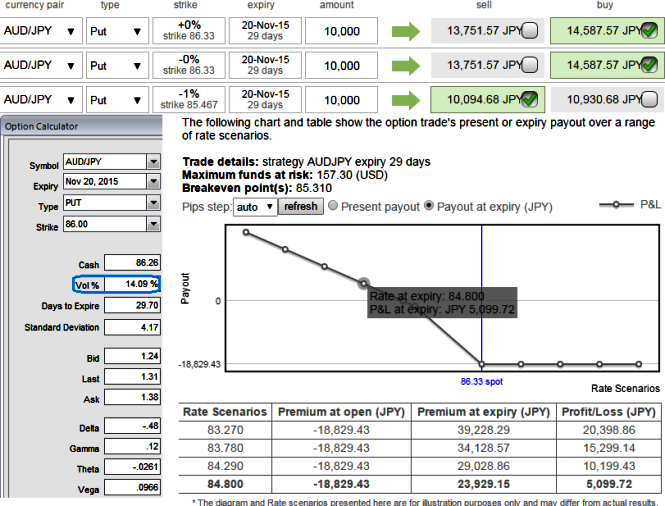

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option.

So far we all know that the position uses long and short puts in the ratio, such as 2:1 or 3:2 and so on to maximize returns depending upon risk appetite and returns expectations.

In most long/short spreads, you make money if the underlying price moves, but you lose if it remains in the middle loss zone. Now with increased volatility option shorter can get benefitted from this.

A ratio put back spread is different because it creates a net credit, so even if the underlying price does not move very much, you keep the credit if all of the puts expire worthless.

Entering into this AUDJPY position which has higher implied volatility at 14.09% and expecting for the inevitable adjustment is a smart approach, regardless of the direction of price movement.

Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

FxWirePro: Shorts in AUD/JPY backspread to beat higher IV

Thursday, October 22, 2015 7:19 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary