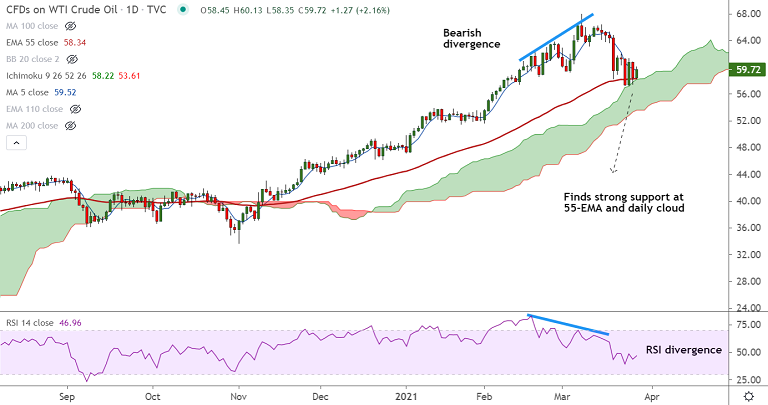

USOIL chart - Trading View

Technical Analysis: Bias Neutral

WTI fails to hold gains above $60 per barrel mark and was trading at $59.77 at around 11:30 GMT

A firmer US dollar limits gains in oil prices and traders ignore Suez Canal blockage and risk-on sentiment.

Price action is extending choppy trade around 55-EMA support, bearish divergence keeps scope for further weakness.

Daily Ichimoku cloud and 55-EMA seem to be offering strong support for the time being, further weakness only on breach below.

Volatility is likely to continue ahead of next week’s OPEC+ meeting (Thursday, April 1st). Analysts see little chances for another hike in output at this point.

Focus on US economic data and Baker Hughes oil rigs count due later today for near-term trading opportunities.

Technical bias is neutral. Breach below cloud and 55-EMA will fuel further downside. Next major bear target lies at 110-EMA at 53.52.

On the flipside, 21-EMA is strong resistance at 61.30, decisive break above could change near term dynamics.