USD has been waiting for December month very curiously, we reckon dollar is most likely to be supported next week after FOMC minutes optimistic readiness of the board to begin the monetary normalization cycle as soon as December.

The pair dropped slightly towards 1.0579, as speculators look ahead for ECB's meeting for further signals of potential divergence in monetary policies in the U.S. and the euro zone.

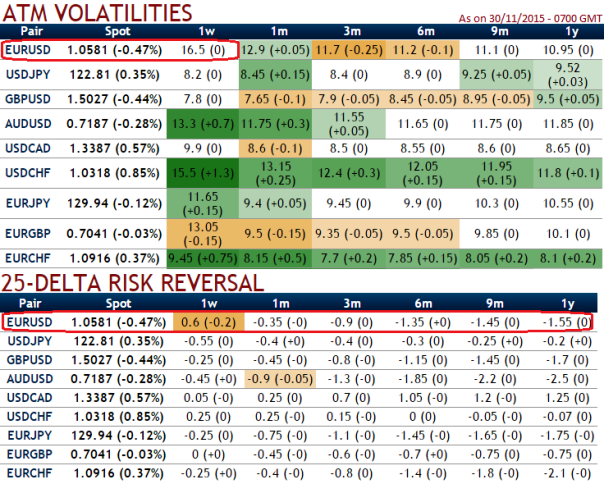

Which in turn prompted hedging activity for currency downside risks, as a result we can understand ATM puts have been costlier where the FX market direction of this is heading towards 1.0525 and 1.0505 technical levels. Currently, it is struggling at 1.0579 levels.

The implied volatility of ATM options with 1w tenor is likely to perceive at 16.5%.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour.

With fed fund futures already pricing about a 70-80% chance of a hike this year, we would expect a modest upward move in the USD as the market fully prices in December as the lift-off date.

Hence, EURUSD's higher IV with negative delta risk reversal can be interpreted as, the market reckons the price has more downside potential for large movement ahead of FOMC season which is resulting derivatives instruments for downside risks have been overpriced.

But any spikes in this pair in near term can be attributed as shorting opportunity in our back spreads.

We eye on shorting (1%) 1w in the money put (this would match 1w risk reversals) which would lock in certain yields by initial receipts of premiums.

Therefore, 3 lots of 1m ATM -0.50 delta puts are preferred to suit the prevailing losing streaks. So thereby the spread would be executed for net debit and the cost is reduced by short side.

Traders tend to view the put ratio backspread as a bear strategy, because it employs puts. However, it is actually a volatility strategy.

So entering the position when implied volatility is high and waiting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

FxWirePro: Who on earth safeguards Euro’s vulnerability – “put back spreads” says the hedgers

Monday, November 30, 2015 12:10 PM UTC

Editor's Picks

- Market Data

Most Popular