From last 9 days of down-streak has continued after breaking support at 0.7237levels. While both leading and lagging oscillators are in conformity to the prevailing downswings.

Currency Hedging Strategy:

The rationale: Any potential downswings should be optimally utilized during high volatility times, so as to participate in that downtrend, weights in the portfolio should be doubled with ATM puts in order to give the leveraging effects. The profitability can be maximized for every shift towards downside and this is not the same on upside.

RBA easing brings in new bearish environment in AUD/CHF but 1M ATM IVs seems still cheaper, anytime OTC FX market for this pair may get intensified.

The Aussie plunged after the central bank announced its official cash rate cut citing a need to spur the economy and encourage a weaker exchange rate, with the move coming after a downbeat Caixin manufacturing PMI survey on China.

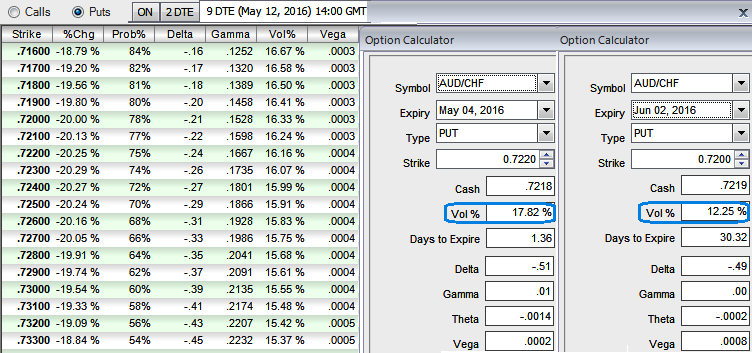

The current ATM implied volatility is spiking at 17.82% (of 1D expiry) and 12.25% for 1M tenors.

If you have to evaluate these vols and premiums with probabilistic figures in distinctive scenarios of OTM strikes, the options pricing seems reasonable, which means more likelihood of these puts expiring in the money.

Considering above fundamental & technical reasoning and OTC observation, the downtrend in long term is certain but because this is heading channel resistance, we want to play it safe and are capitalizing a bit on this ongoing downtrend by using recovery rallies with an objective of profit maximization.

Hence, weights in the strategy have to be more o long side to cushion downside risks, as a result, we recommend holding 2W at-the-money 0.51 delta call and simultaneously hold the double the size of calls, 2 lots of 1M at-the-money -0.49 delta put options.

The significance of the above strategy:

If you’re lucky and the down-move as anticipated above essentially takes place – you will make huge than had you implemented just the straddle strategy which is neutral.

You can expect that profits from 2 puts are more than 1 call.

On the contrary, please be noted that the trader can still make money even if you go wrong – but the underlying spot FX has to move in the opposite direction really fast.

Thereby, the 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Risk is Limited to the price paid to buy the options.

Reward is Unlimited till the expiry of the option.