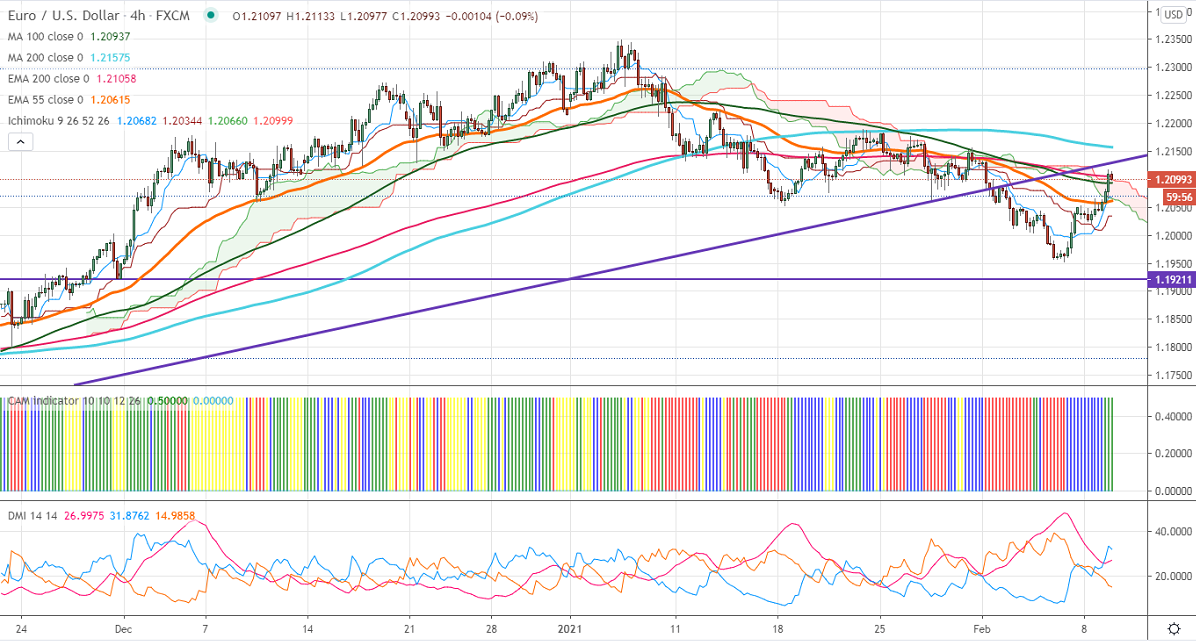

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.20682

Kijun-Sen- 1.20344

EURUSD surged more than 150 pips from a low of 1.19573 onboard based US dollar selling. The slight pessimism on the size of the relief package and declining US bond yield is putting pressure on the US dollar. The US 10-year yield has lost more than 4% from a multi-year high of 1.18% on weak US jobs data. The spread between US bond and German bund now trades around 160 bps vs 100 bps in Mar 2020. The pair hits an intraday high of 1.21165 and is currently trading around 1.20984.

Technical:

On the higher side, near-term resistance at 1.2160. Any indicative violation above targets 1.2200/1.2260. The next support is around 1.2050. Breach below will drag the pair down till 1.2000/1.19550/1.1900.

It is good to sell on rallies around 1.2148-50 with SL around 1.2200 for the TP of 1.1955.