WTI is continuing its downward slide, as Middle East tensions failed to lead into greater crisis.

Key factors at play in Crude market

- Middle East tensions between Iran and Saudi Arabia bearish for crude as it means supply war between two rivals.

- US lawmakers passed bill to lift 40 year oil ban on US crude export.

- Brent has fallen to discount against WTI.

- OPEC remains dysfunctional without ceiling.

- Due to new and improved technologies, crude oil production cost has declined for shale producers.

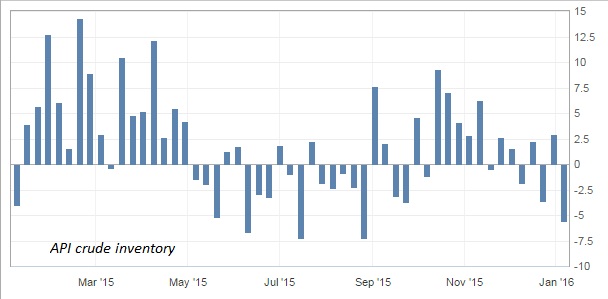

- American Petroleum Institute's (API) weekly report showed inventory dropped by -5.6 million barrels, highest since last August.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:30 GMT.

Trade idea

- We at FxWirePro remains committed to downside, price action suggests further drop in prices likely towards $33.5, $28.5 and $23. WTI is currently trading at $34.8/barrel.