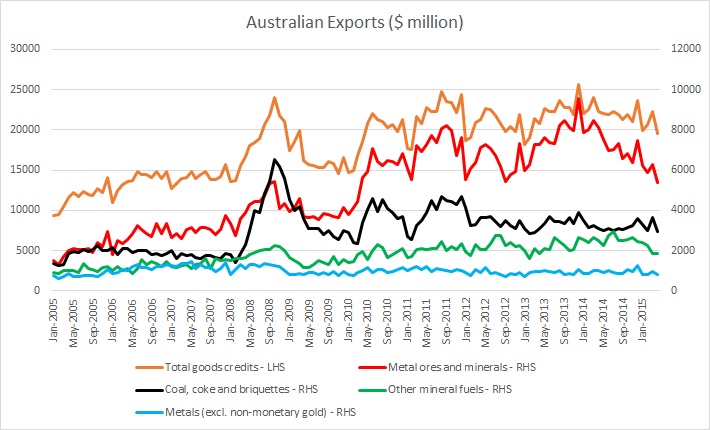

After enjoying decades long commodity export boom, Australian economy since 2013 facing severe jolts in its commodities namely metal ores and minerals export portfolio.

- Global slowdown in consumption and bust of vicious glut of China is contributing to the downfall and latest data suggests that slowdown showing no signs of stabilization.

Australian trade deficit and details are providing ample evidence of such.

- Balance on goods and services ran a deficit of $1,883m in April 2015, an increase of $292m (18%) on the deficit in March 2015. In seasonally adjusted terms, the balance on goods and services was a deficit of $3,888m in April 2015, an increase of $2,657m (216%) on the deficit in March 2015.

- Exports fell $1,561m (6%) to $25,659m as coal, coke and briquettes, exports were down $859m (22%). Authorities are attributing some of the slowdown to port closure due to severe weather, the above chart shows, slowdown is trending. China has reduced imports of Coal, Iron ore and other minerals.

Even if growth bounces back in China, changing policies suggest there may not be boom time like before. China will move its economy from export, re export to domestic consumption oriented. As of now, Chinese economy doesn't look to be reversing its downfall.

Australian economy clearly needs further stimulus.

Fiscal stimulus in terms of tax break for miners or subsidies for SMEs are required, however current deficit won't be allowing Australian government to open the tap.

So all now rests on Reserve bank of Australia (RBA) and monetary policy stimulus. Australian needs its exchange rate to relatively much lower to weather the bust.

Australian dollar, which is currently trading at 0.771 against dollar, likely to remain depressed and it would be good for Australia if it does.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings