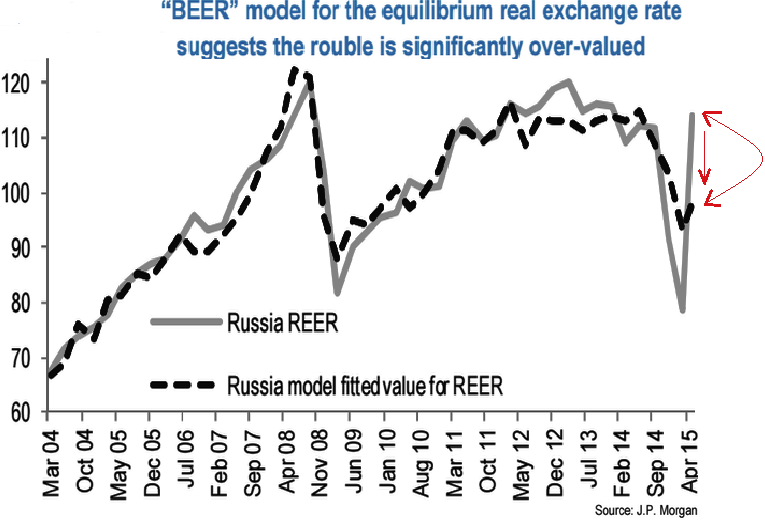

We estimate a Behavioral Equilibrium Exchange rate model for Russia to establish to what extent REER movements have been driven by an adjustment to its equilibrium values, consistent with changing fundamentals.

Although the rubles nominal exchange rate is closely nearing to fair value in short-term models given the price of oil and sovereign credit spreads, the REER seems overpriced at present levels.

Retreating Russia's REER against oil prices and productivity differentials relative to the US and euro area (BEER model for equilibrium) advocates that it is now around 15% overvalued as diagram shows.

The estimates of the speed of convergence of the real exchange rate to its equilibrium value suggests that around 60% of the valuation gap should close in the next two quarters implying a 9% REER depreciation over the course of two quarters.

Catalysts for deprecation over the summer include an acceleration of FX reserve accumulation, diminishing use of the FX repo facility, and a seasonal deterioration of the current account and external debt repayments.

BEER model suggests REER of RUB to contrast

Wednesday, June 3, 2015 8:01 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary