At its two-day policy meeting which concludes Nov 1st, the Bank of Japan (BoJ) is widely expected to keep unchanged its minus 0.1 percent short-term interest rate target. In a quarterly evaluation of its forecasts also due at next week's policy meeting, the central bank is likely to cut next fiscal year's inflation forecast slightly, reflecting weak consumption and falling import costs.

The BoJ's massive asset purchases have failed to jolt the economy out of stagnation and the central bank at its September meeting switched to a policy of targeting interest rates rather than the pace of its money-printing. The BOJ's policy targeting the pace of money printing has been replaced by a complex "yield curve control" with a short-term rate target of minus 0.1 percent and a 10-year bond yield target "around" zero percent.

"Rates to remain unchanged in the foreseeable future. Move from balance sheet expansion to yield curve control (with target for 10y yield at ~0.0%) point towards tapering of asset purchases in the near term (we expect by year-end)," said DNB markets in a report.

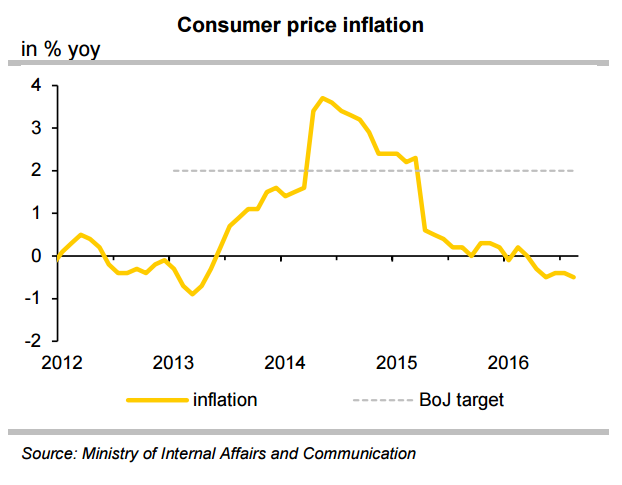

Japan headline inflation data released on Friday showed that deflation continues in Japan with little evidence of price pressures. Data released by the Statistics Bureau showed Japan's national consumer price index declined at an annualized 0.5 percent in September. Core inflation fell for a seventh straight month as household spending slumped, reinforcing the view it will take some time for inflation to accelerate to its target.

BoJ governor Haruhiko Kuroda earlier on Thursday played down necessity for more easing in the short-term, squashing hopes of any surprise next week. Kuroda said on Thursday the central bank would not try to push down super-long government bond yields - even if they rise further - because it is focused on controlling the yield curve for out to 10 years.

USD/JPY trading a tight range on Friday as markets await the crucial U.S. GDP data. The pair broke out in an upward direction from a triangle flag pattern in October, and downward pressure temporarily eased. At the time of writing at around 10:45 GMT, USD/JPY was trading largely unchanged at 105.26.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election