Sun is shining brighter today, however the whole week was clouded by risk aversion stemming from China's stock market drop and more so drop and volatility in China's Yuan. This week Yuan has depreciated around 1.5% against Dollar.

Rise of volatility is definitely concerning, especially so for emerging markets, where investors hunt for higher yields and their return gets depressed along with Sharpe ratio, when volatility in currency rises. Emerging market currency tend to underperform at time of higher volatilities. But China is no ordinary emerging market, it is world's second largest economy with one of the highest debt to GDP ratio and largest Forex reserve.

We at FxWirePro, can't say that we are big volatility fan, however in this piece we are to present brighter side of volatility, for Yuan.

Our theory lies with the following pertinent question -

Who wants to trade an instrument/Currency that doesn't move? (Unless you are looking for peg break or something of that sort).

We don't.

It is worth seeing the true nature of China's currency policy. Listing it to International Monetary Fund's (IMF) SDR basket is not the goal.....it is merely a step in right direction. True goal is to make Yuan acceptable internationally, making it a truly global currency.

What is better way than to make trades and transactions happen in Yuan. Since we are still in early stages of Yuan acceptability, making it acceptable for trade transactions as international reserve, do require some sort of volatility curb, which Chinese regulators and PBoC are quite good at. Hence the 2% band.

Other part is to let Yuan gets traded in financial market and our guess is volatility is good for that.

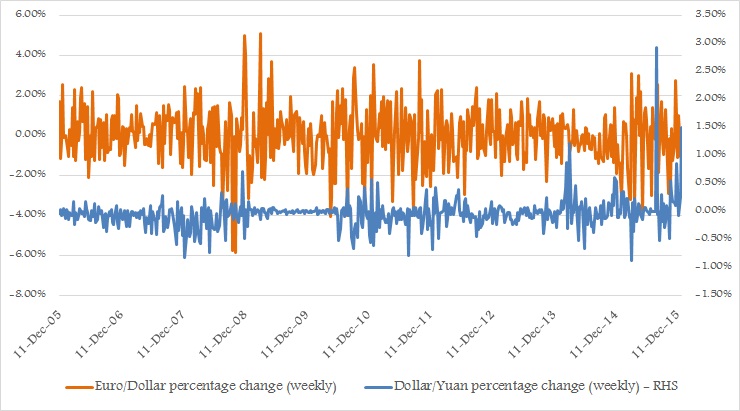

Our historical analysis, since Yuan's life after de-peg back in 2005, shows only 6 times or so Dollar/Yuan has moved more than 1% in a week, while for world's most liquid pair (EUR/USD), almost an regular norm.