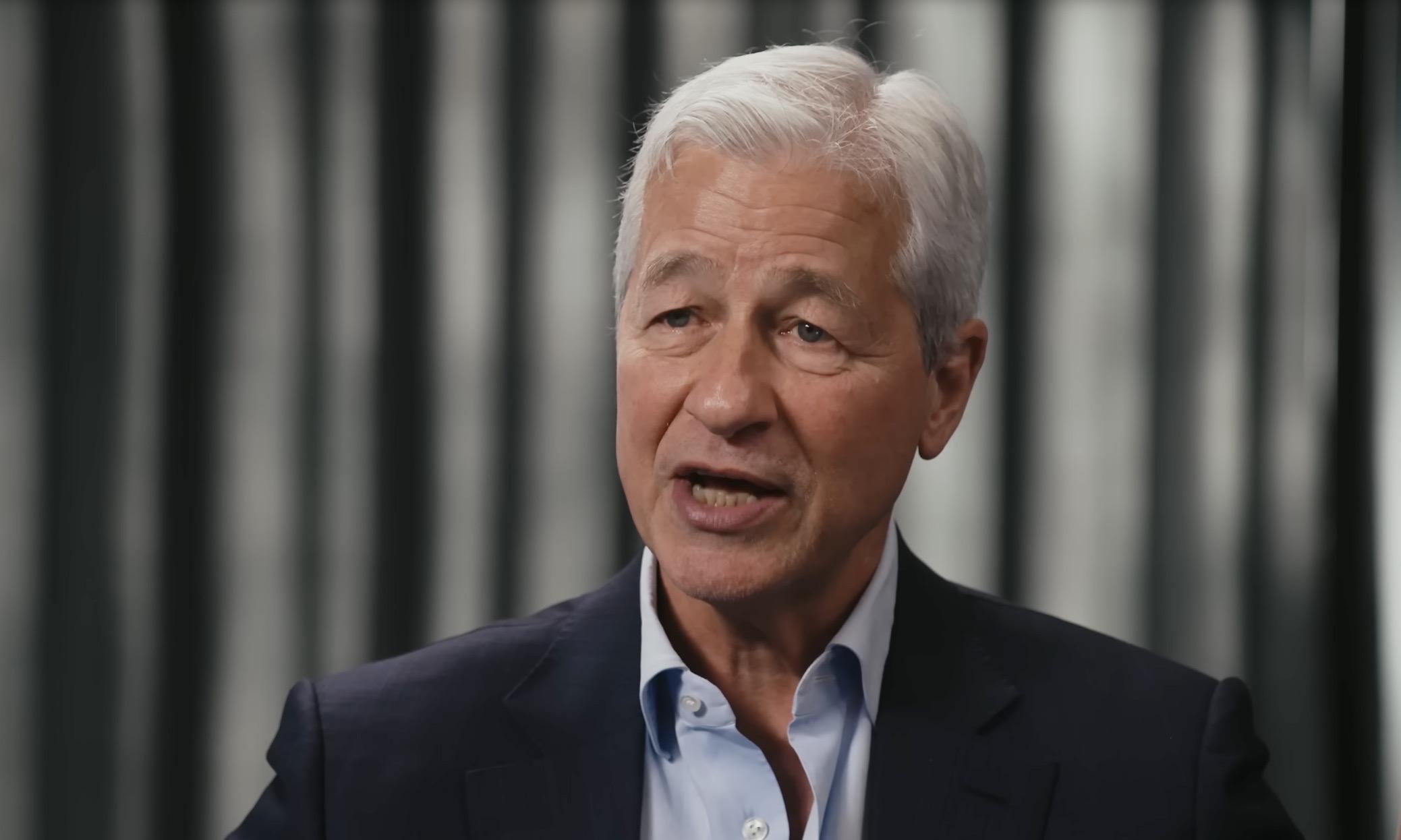

JPMorgan CEO Jamie Dimon has underscored the critical role of artificial intelligence in reshaping the financial industry, detailing plans to integrate AI across various banking functions. In his vision, AI will enhance customer interactions, streamline operations, and improve employee productivity despite potential job disruptions.

JPMorgan's Enhanced AI Plans Set to Revolutionize Customer Service and Banking Operations

JPMorgan's wealth plans currently use AI, but the technology will soon become considerably more advanced. According to Dimon, "All that is going to do is know more about you, learn more about you, look at patterns and, you know, look at successful things in the past. AI is going to be a huge aid to things like that."

Will you be able to turn to the bank's future chatbot – let's call it ChatJPM – and say, "I have 30 years, what should I do?" Yes, says Dimon. "We, in some ways, can do that a little bit already today," he said in an interview.

According to Bloomberg, in a recent letter to shareholders, Dimon emphasized the relevance of AI to JPMorgan and society as a whole. He compared the new technology to the "printing press, steam engine, electricity, computing, and internet."

The New York-based bank already employs thousands of people working on AI. Dimon has previously stated that AI will frequently be integrated into the bank's functions, including trading, research, stock hedging, and customer support, as a type of copilot. AI is expected to significantly improve workers' quality of life, but like with any new technology, some jobs will be lost, Dimon said.

AI in Finance: Boon for Efficiency but a Bane for Stability and Fairness

AI tools are already generating cash for the bank, and future technological advancements are anticipated to yield even greater benefits. However, AI poses hazards to the financial system. According to Gary Gensler (via SCMP), the head of the US Securities and Exchange Commission, technology can make it difficult to understand why decisions are made while also increasing volatility and instability.

Gensler was among the first regulators to suggest rules for AI that would require trading firms and money managers to examine whether their use of AI or predictive data creates a conflict of interest. And US Representative Maxine Waters, the leading Democrat on the House Financial Services Committee, has cautioned that financial corporations' use of the technology may lead to further discrimination in lending.

Regarding how AI will change how ordinary people deal with money, Dimon does not see a single finance "superapp," a word that describes applications that can do practically anything.

In 2018, he sent a team to China to learn about popular platforms like Alibaba Group Holding's Alipay and Tencent Holdings' WeChat, which combine social networking, e-commerce, and payments into a single hub. The team returned and created a chart depicting all of China's super apps and their services; Dimon determined that instead of a single "everything app" in the US, there would be a slew of "mini superapps."

JPMorgan now provides credit card services and is growing into travel, restaurants, and lodging. "There are all these adjacencies on everything we do that will be, are tech-driven, and will be increasingly AI-driven," he said. "So think of anything we offer you will be driven a lot by AI."

What if you tell a future, hypothetical JPMorgan chatbot that you want to get rich quickly?

"I hope it tells you that you're crazy," Dimon said, pointing out that technology still has its limits. "AI can't be a stock picker."

Dimon believes that even if every stock were perfectly priced, AI could not make faultless decisions. However, he believes AI will get us closer to a world where we can put our money on autopilot.

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil