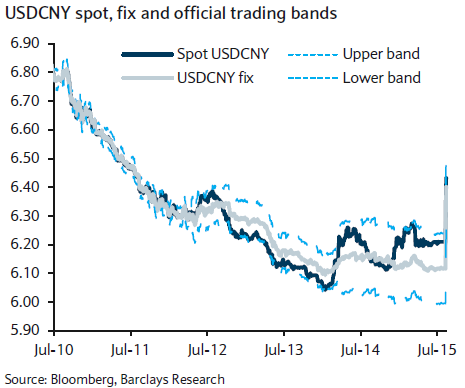

Adjustment in the USDCNY fixing was announced earlier this week as a further step towards liberalising the domestic FX market. The move also reflects the fact that the CNY REER has been far stronger than other currencies. Weaker trade data seem to have increased pressure on the authorities to allow greater currency flexibility. In fact, the CNY REER has appreciated about 18.5% since mid-2014, a far bigger rise than most other currencies, as China has not let the CNY weaken despite a broadly stronger USD, notes Barclays.

The PBoC noted that it will increase yuan flexibility while moving towards convergence of onshore and offshore rates. Importantly, China's central bank now decides the yuan midpoint based on market-makers' quotes, together with closing quotes. The implication is that the fixing will be much more dependent on the market and could move in a more volatile and potentially weaker trajectory than previously, depending on market movements, states Barclays.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX