Canadian real GDP grew by 0.5 percent in July, adding to June’s 0.6 percent gain. The July GDP gain exceeded economists' consensus of 0.3 percent. The strong July result was mainly driven by a continued recovery in oil production and petroleum-product manufacturing, following the devastating Alberta wildfires.

The second straight month of growth is bolstering confidence that the economy is back on track after being marred by the Alberta wildfires. The underlying details of the report showed July’s growth was actually broadly based, with 18 of 21 sectors showing growth.

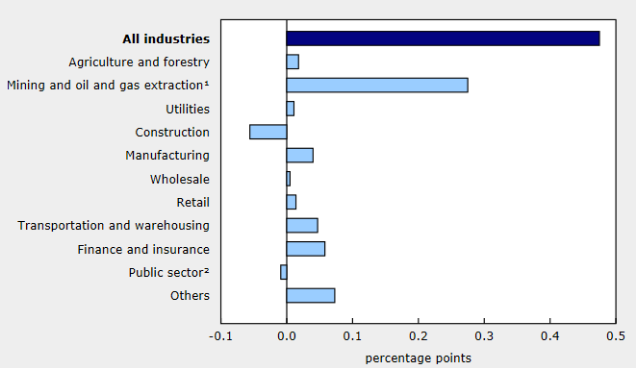

The goods-producing side of the economy rose 1.0 percent on the month, led primarily by gains in mining, quarrying, and oil and gas extraction. The services sector increased 0.3 percent month-over-month in July, with most sectors posting an increase. Overall, the report shows modest growth in July, with growth excluding mining, oil and gas, coming in at a more modest +0.2 percent month-over-month.

Despite the robust growth over the past two months, the big question for the Bank of Canada (BoC) is export performance. BoC flagged exports as an area of concern in the latest policy statement. A soft report would reinforce those concerns, raising easing odds. BoC is thus likely to focus more on the evolution of trade (August data are due October 5th) and to maintain the somewhat dovish bias that has emerged in their recent communication in an effort to talk down longer-term rates.

"While there’s no arguing that the risks to BoC policy remain skewed toward easing, the backdrop just isn’t compelling for a move at present. The rebound from the wildfire will boost Q3 and we’re still waiting to see the impact of fiscal stimulus. That points to continued patience from Governor Poloz," said Benjamin Reitzes, Senior Economist at BMO Capital Markets.

Recovery of the oil price has helped the CAD to gain some ground against the USD. USD/CAD is extending declines from multi-month highs of 1.3280 hit on September 27th. The pair was 0.28 percent lower on the day at the time of writing, trading at 1.3086 at around 12:00 GMT.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom