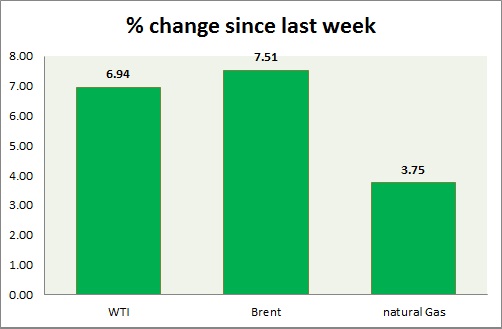

Selloffs in the energy segment gathered pace in today's trading as strong supply and stronger dollar continue to weigh on price. Weekly performance at a glance in chart & table -

- Oil (WTI) - WTI lost grounds in today's trading but still maintaining above the key support but recent pressure of selling suggests that level might break upon which it might see sharp drop. Breaking the support could push the price as low as $42/barrel. WTI is currently trading at $48.8/ barrel. Immediate support lies at 48 and resistance at 52.

- Oil (Brent) - Supply concerns over Middle East continues to weigh on price. Selloffs gathered pace after key level got broken. Further decline can't be ruled out. Brent-WTI spread narrowed further and trading just below $8, down from $13 last week. Brent is trading at $56.5/barrel. Immediate support lies at 53.6 & resistance at 61.

- Natural Gas - Natural gas, failed to gain over last week's rally. Focus is now on inventory data. Price remained trapped between tight ranges Natural Gas is currently trading at 2.72/mmbtu. Immediate support lies at 2.65 & resistance at 2.87.

|

WTI |

-2.03% |

|

Brent |

-5.28% |

|

Natural Gas |

-3.87% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?