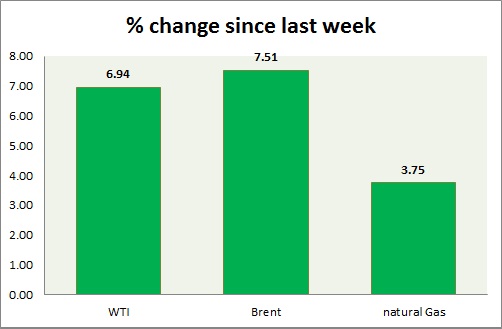

Energy as an asset class is the worst performer in today's trading and this week's. Weekly performance at a glance in chart & table -

- Oil (WTI) - WTI selloffs accelerated as expected after key support level got broken. WTI is yet to reach initial target of $42/ barrel. WTI is currently trading at $45.20/ barrel, down nearly 4% today. Immediate support lies at 42 and resistance at 48.3.

- Oil (Brent) - Brent fell in today's trading but gained over the spreads. Brent-WTI spread is trading at $ 10.7, support lies at $8 and resistance at $13. Price pattern suggests a move towards $ 53/barrel is likely as key support at 58 was broken. Brent is trading at $56.09/barrel. Immediate support lies at 53.2 & resistance at 58.4.

- Natural Gas - Natural gas prices fell as inventory shrinkage was lower than previous, however inventory fell below 5 year average. Natural Gas is currently trading at 2.69/mmbtu. Price range is squeezing, there might be breakout ahead. Immediate support lies at 2.65 & resistance at 2.87.

|

WTI |

-8.67% |

|

Brent |

-5.95% |

|

Natural Gas |

-5.28% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?