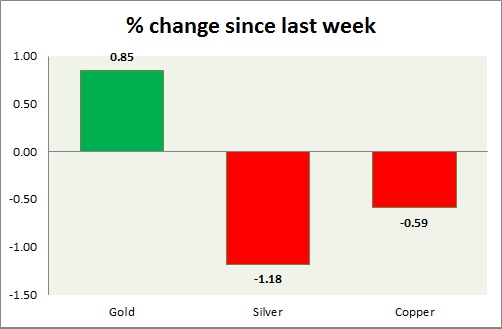

Metals are lacklustre despite weakness in Dollar. Performance this week at a glance in chart & table -

Gold -

- Gold faced selloff from around $1185 area. Today's range - $1185 - $1176

- Gold might reach $1152 area, since $1178 support got broken. Stop is around $1200.

- Focus is on FED next week.

- Gold is currently trading at $1181/troy ounce. Immediate support lies at $1152 and resistance at $1224, $1236-1240 area.

Silver -

- Silver has broken below $16 going to test resistance once more. Today's range $16.1-$15.8.

- Mint ratio is down by 0.75% today, currently at 74.2. Mint ratio and precious metal prices are inversely related more often than not.

- FED is make or break event for silver as it tests key support.

- Silver is currently trading at $15.9/troy ounce. Support lies at $16, $15.42 & resistance at $17.5-17.7, 18.4-18.7.

Copper -

- Copper failed to jump from key support today as it tested $2.65 intraday. FED could become make or break event for FED.

- Next target is around $2.52/ pound if support at $2.65 gets broken.

- Copper is currently trading at $2.68/pound, immediate support lies at $2.65 & resistance at $2.84, $2.89, $2.95.

|

Gold |

+0.85% |

|

Silver |

-1.18% |

|

Copper |

-0.59% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate