Dollar index trading at 96.02 (-1.45%).

Strength meter (today so far) - Aussie +1.74%, Kiwi +0.84%, Loonie +0.6%.

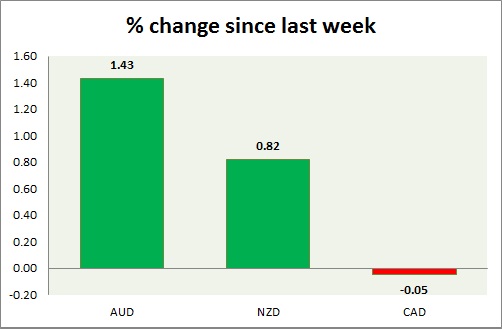

Strength meter (since last week) - Aussie +1.43%, Kiwi +0.82%, Loonie -0.05%.

AUD/USD -

Trading at 0.775

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796, Immediate -0.787

Economic release today -

- RBA held policy steady.

- Australia's current account balance for first quarter came at -10.7 billion.

Commentary -

- Aussie gained solid today as dollar weakened and RBA kept policy steady. Aussie to move upwards further but likely to face selling pressure near immediate resistance.

NZD/USD -

Trading at 0.716

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.70, Short term - 0.71-0.708

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.719-0.721

Economic release today -

- NIL

Commentary -

- Kiwi bounced back amid weaker dollar, however gains would be limited as RBNZ rate decision looms ahead.

USD/CAD -

Trading at 1.245

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy Support

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217, Immediate - 1.238-1.236

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28

Economic release today -

- NIL

Commentary -

- Canadian dollar gained but remained the worst performing commodity currency so far this week. Weak economic releases raised possibility of further rate cut.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate