Dollar index trading at 95.19 (-0.06%)

Strength meter (today so far) - Aussie -0.08%, Kiwi +0.06%, Loonie +0.76%.

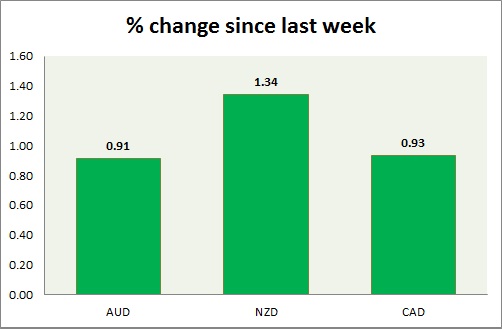

Strength meter (since last week) - Aussie +0.91%, Kiwi +1.34%, Loonie +0.93%.

AUD/USD -

Trading at 0.768

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796, Immediate -0.772

Economic release today -

- NIL

Commentary -

- Aussie is bouncing back amid stronger dollar. Sellers are likely to prevail at rallies.

NZD/USD -

Trading at 0.713

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.70, Short term - 0.71-0.708

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.719-0.721

Economic release today -

- NIL

Commentary -

- Kiwi faces test of key support at 0.7 this week as RBNZ is scheduled on 10th at 21:00 GMT. Bounce back amid weak dollar, however likely to remain range bound.

USD/CAD -

Trading at 1.231

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy Support

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217, Immediate - 1.238-1.236 (broken)

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28

Economic release today -

- NIL

Commentary -

- Canadian dollar is the best performing commodity currency as oil price bounced back sharply/ Loonie remains sell against dollar, however higher oil price might push the pair lower.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate