Today US Energy Information Administration (EIA) will release data on inventory at 14:30 GMT.

- Last week according to EIA, there was inventory drawdown of -2.67 million barrels, today it is expected that another drawdown of -1.8 million barrels.

- Crude is unlikely to make much if inventory falls, however a rise in inventory might push prices lower.

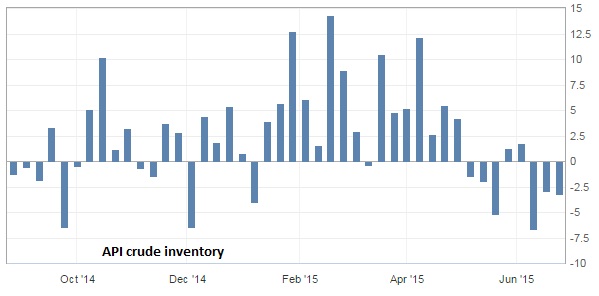

- Inventory report from American Petroleum Institute (API) showed drawdown of -3.2 million barrels. Forecast was drawdown of -2.3 million barrels. Previous drawdown was -2.9 million barrels. According to API data inventory dropped in last 5 out of eight weeks.

Brent crude is currently trading at $64.3/barrel, down -0.26% today. WTI crude is currently trading at $60.9/barrel, down -0.20% today so far.

This is the eighth week running, WTI remains trapped between $62.4 and $56.7 when considering highs and lows.

It is advised to go long or short on crude depending on technical breakout. Fundamentally the market still remains oversupplied.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate