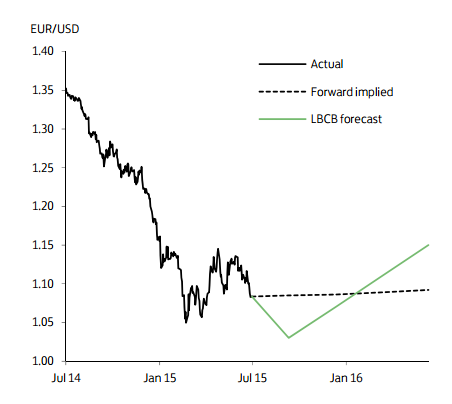

EUR/USD has been dominated over the past month by the tumultuous events in Greece and, to a lesser extent, shifting expectations of US monetary policy. Over much of this period, it has been caught in a range around 1.11, with downside pressure on the euro from the Greek crisis broadly offset by downside pressure on the US dollar from a scaling back in US interest rate expectations.

More recently, however, news of a tentative deal between Greece and its creditors has seen the single currency break lower, below 1.10. The drop has occurred amid (i) scepticism over whether a Greek deal can be finalised; (ii) renewed speculation of a possible rise in US interest rates this year; and (iii) the euro's status as a funding currency (investors have naturally sought to borrow cheap euros to purchase foreign currency assets).

"A resolution to the Greek crisis coupled with a steady recovery in euro area economy should see EUR/USD move higher over the longer term. For now, however, ongoing event risk in Greece, the probability of a US rate rise in H2 and the ECB's QE are projected to push the euro lower. We target a drop to 1.03 by end Q3," says Lloyds Bank.

EUR/USD Outlook

Monday, July 20, 2015 8:38 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX