Monetary policies continue to drive equities and investor across world. Whereas hawkish Federal Reserve (FED) raising concerns over US equities, European counterparts enjoying ultra-loose monetary policies by European Central Bank (ECB).

- Last week, US equities completed their consecutive third weekly decline, S&P 500 is down close to 1% this year so far. It may not sound much but is a lot when compared European and Japanese counterparts.

- Eurostxx 50, that includes stocks pan Europe, is up 17.6% this year. German stock index DAX is up 22.2% YTD. Japanese Nikkei is up about 10% YTD. France's CAC40 is up 17% YTD. Italy's FTSE MIB is up by 20% whereas Spain's IBEX is up 8% YTD.

Interest rate rise by FED, may not break the US indices to the lower side but may lead to further underperformance. Moreover a stronger US dollar is expected to hurt exporters as well as affect global revenues earned by US companies.

Fund flow -

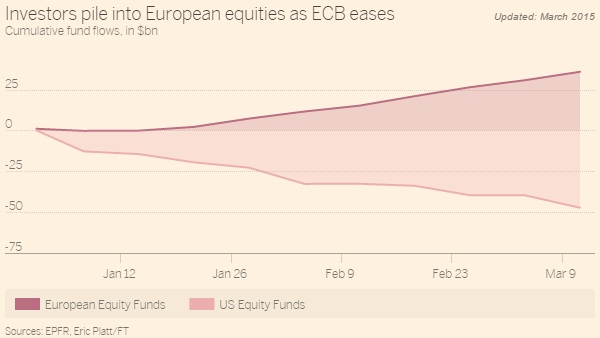

- Investors are taking profits out of American equities in favor of European ones at a faster pace since the beginning of this year.

- As evident from the chart, courtesy to financial times, investors poured in money to European equities more than $ 25 billion, whereas US equities saw outflow close to $ 50 billion.

Euro raced to 1.05 against the dollar with ECB buying € 60 billion worth of securities every month making the valuation of European equities much cheaper. With divergence in monetary policies the trend is expected to stay for now. Moreover unlike US stocks and indices many of the European ones have not reached the pre-crisis level.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate