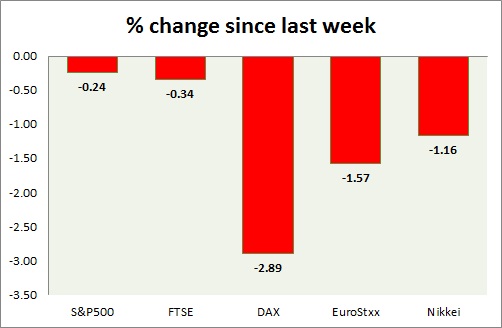

Equities are shedding of gains over profit booking. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark is losing ground today after yesterday's big rally. Building permits increased to 1.092 million however Housing starts dropped to 0.897 million in February. Redbook index increased 1% mom and 2.7% YoY. SPX500 is currently trading at 2070, down 0.33% for the day. Immediate support lies at 2040 and resistance 2081.

- FTSE - FTSE gained in today's trading despite fall in other indices. FTSE is trading at 6818, up 0.22% for the day. Price pattern suggests the index might fall as low as 6560. Support lies at 6690 and resistance near 6860.

- DAX - DAX, is hit by profit booking ahead of FOMC tomorrow after weeks of rally. It has broken below 12,000. German Zew survey economic sentiment improved to 54.8 from previous 53 but below expectation of 58.2. Current situation improved to 55.1 from previous 45. DAX is currently trading at 11990. Immediate support lies at 11740.

- EuroStxx50 - Stocks across Europe is seeing sell offs prior to tomorrow's FOMC. Germany is down (-1.65%), France's CAC40 is down (-0.96%), and Italy's FTSE MIB is down (-0.90%) whereas Spain's IBEX is down (1.13%). EuroStxx50 is currently trading at 3662, down 1% for the day. Support lies at 3635, 3555.

- Nikkei - Nikkei touched above 19500 in intraday trading but was sold off sharply as global selloff resumed over risk aversion due to upcoming FOMC. Nikkei still might move towards its target of 20,800. Nikkei is trading at 19390. Immediate support lies at 19200, 19000.

|

S&P500 |

0.98% |

|

FTSE |

0.86% |

|

DAX |

0.08% |

|

EuroStxx50 |

-0.25% |

|

Nikkei |

0.63% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate