European credit market has remained calm, even as Greece inches closer to exit.

Probability of a Greek exit from Euro zone has increased dramatically as a no verdict on Sunday's referendum according to European leaders would mean no towards Euro zone.

Greece after calling the referendum has tried to negotiate, which was rejected by Chancellor Merkel as she indicated that there would no negotiation until the referendum is over.

However, this is 2015 not 2011/12. Euro zone is now much better prepared to handle such crisis, though an exit by Greece would weaken the structural integrity of Euro zone and might have greater Geo-political consequences.

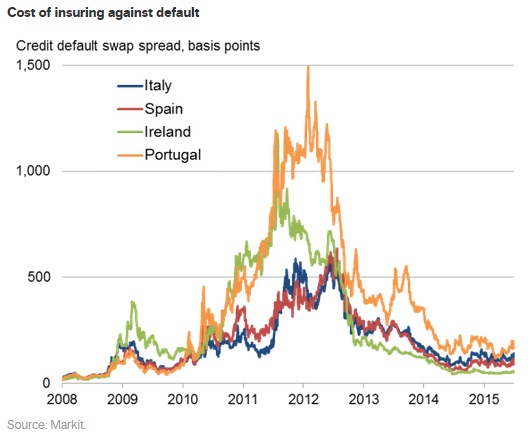

The credit market is showing the crisis this time is limited to Greece and not likely to affect entire Euro zone.

The chart from Markit shows the Credit default Swaps of peripheral countries, which is showing no signs of tensions.

In 2012, at peak of the crisis, CDS spread on Portugal, Italy, Spain, Ireland, all sky rocketed. Portugal traded as high as 1500 basis points, this time around all are around historical average between 0 to 200 basis points.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand