Euro is continuing its bullish run for third consecutive day, pushing dollar sharply lower.

Euro run which started over Greek deal optimism, now getting the further fuel from European bond yields. Sellers are back in European bond market.

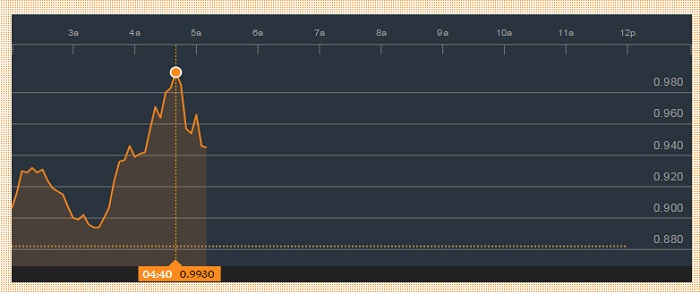

- German 10 year yields are up 5.33%, trading at 0.93% today. Yield is likely to move further above, technically speaking 1% mark might provide some interim resistance as profit booking. Yield traded as high as 0.993% in today's trading.

- Extremely once sided position in short yield trade is leading to massive rally over short covering. Higher than expected inflation reading provided the necessary boost.

- European Central Bank's € 1.1 trillion asset purchase program can influence the yield more on the shorter end of the curve and less on longer end of the curve.

However low yield makes it attractive to bet for inflation, considering the risk reward ratio, however traders should be cautious as European recovery have gather pace but remains far from levels what can be considered as normal.

Euro is benefiting from both rising yields and market optimism on Greece, currently trading at 1.133, up 0.65% against dollar. Euro is likely to surpass the prior high at 1.145 against dollar. This correction was long due in Euro.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate