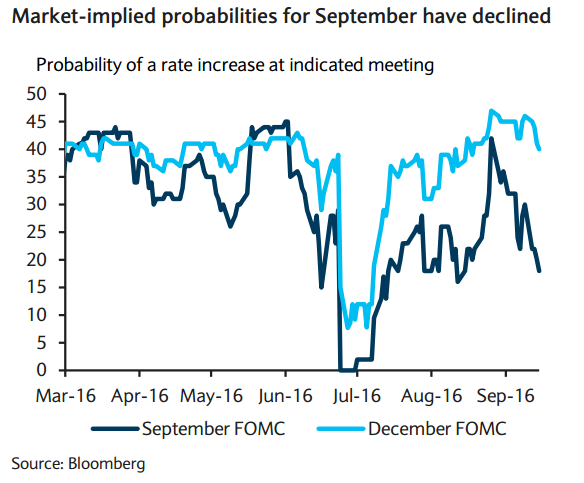

The probability the market attaches to a rate rise at FOMC decision due Wednesday now stands at just 20 percent. While the recent run of US economic data has reduced the likelihood of a rate hike at Wednesday’s meeting, the focus will be on Fed Chair Yellen’s conference and the signals that the FOMC send around the prospect of a rate hike before year-end.

The FOMC kept its target policy range for the federal funds rate unchanged at 25-50bp at its June and July meetings and all FOMC participants expected at least one rate hike in 2016. Incoming data since mid-year have generally improved and external risks have diminished. Communications from many FOMC members also indicate a willingness to prepare markets for the next rate increase.

The inflation data have evolved generally in line with the Fed’s forecasts, pass-through effects are clearly fading. "If Fed officials were focused only on the employment situation, the probability of tightening in September would be high. However, inflation is also a key consideration, and the latest data argue for patience," said Daiwa Capital Markets in a report. The consumer price index showed a hint of pressure in August, but much of the upside surprise seemed to reflect random volatility.

The July reading on the price index for personal consumption expenditures was well contained, with the headline index showing no change and the core component increasing only 0.1 percent. The restrained nature also was evident in the Dallas Fed's trimmed mean PCE price index, a measure frequently mentioned by Fed officials. This index rose less than 0.1 percent in July, which pushed the annual inflation rate back to the low portion of its recent range.

Fed most likely on hold in September and is likely to remain on the sidelines in November because of the upcoming presidential election. Many market participants are shifting their focus to a potential change at the FOMC meeting on December 13-14. Assuming policy is left unchanged, from a market perspective, the reaction is likely to depend on the tone of the accompanying statement and forecasts, and the extent of any dissent.

The greenback remains on the defensive against its main rivals on Monday. The dollar index was down 0.14 percent at 95.91, EUR/USD was up 0.08 percent at 1.1158 and USD/JPY down 0.36 percent at 101.86 at around 11:50 GMT.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand