Technical glimpse:

On intraday charts, leading oscillators such as RSI and slow stochastic suggest rising price convergence with substantial volume confirmation. RSI showing strength in buying interest by converging its curve at 64.4327. While slow stochastic has crossed above 80 levels but there is significant call of overbought pressure. Overall, intraday seems to be uptrend and buy at dips should be the trade idea.

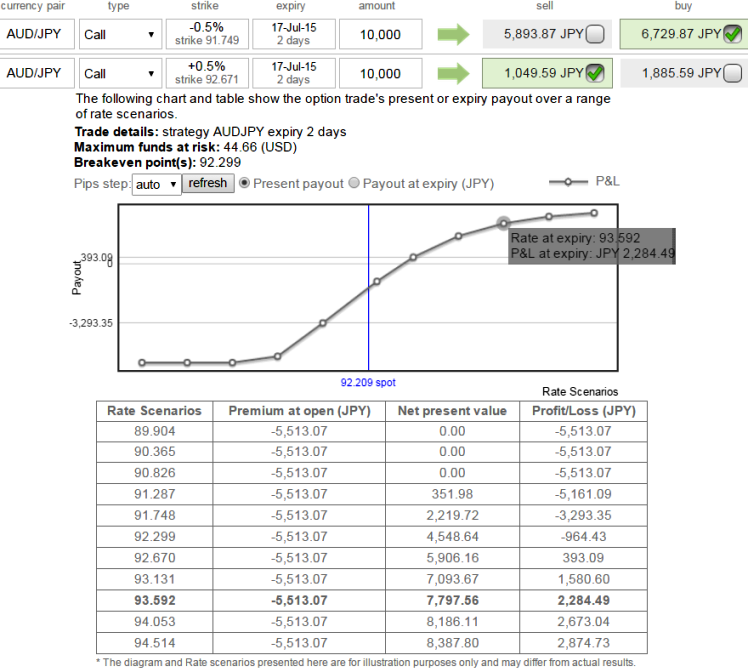

Tunnel Option Structure

The Tunnel is structured as a binary version of a conventional call spread, i.e. long the ITM call and simultaneously short the upper strike.

Therefore an In-The-Money tunnel would be formed of an In-the-money 0.71 delta call below the current asset price less an Out-Of-The-Money call above the current asset price. The delta of 0.43 on combined position with slightly negative theta is preferred on this execution.

As shown in the diagram, if the prices were ¥6729.87 and ¥1049.59 respectively then the tunnel would be worth buying at ¥5680 that offers a 200% return to the aggressive client that fancied the asset price settling between the exercise prices at maturity.

Like in our earlier post if the straddles or strangles were to short vol then one sells the strategy. Likewise conversely, with the tunnel if one wishes to short 'vol' then one buys the strategy.

FXWirePro: Speculate AUD/JPY on asset price volatility using binary tunnel construction

Wednesday, July 15, 2015 7:05 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?