Today at 14:30 GMT, EIA will be polishing details on crude inventory. Few vital facts are laid out before the release.

- Active rig count has fallen to 822, down by 46% since October peak.

- US active storage capacity is down by 60%, raising fear of theoretical oil spill.

- US production has gone up, despite fast closing down of active rigs. Current production rate is around 9.4 million barrels/day.

- Total crude stocks in US stands around 450 million barrel excluding the strategic reserve which is around another around 650 million barrels. This makes total crude stocks in US at 1.1 billion barrels almost four months' worth of sole supply.

Changes to look for -

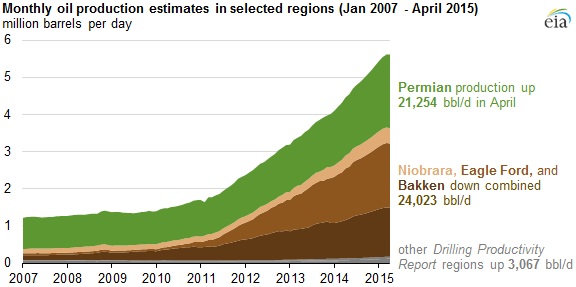

- Production in some areas finally showing some effect of rig closure. In April, according to EIA oil producing regions will see some production cut.

- Niobrara, Eagle Ford and Bakken to see production cut of 24,023 barrel/day.

- For Permian region production in fact will grow by 21,254 barrel/day. Other regions will see an increase of 3067 barrel/day thus nullifying any cut in total production.

Only if rig counts continue to fall at this rate and dent production in such that refiners taking the oil from storage then only WTI might see significant rebound. That still looks farfetched with US production at current level.

WTI is currently trading at $42.22/barrel, down 2.8% for the day. Spread might deteriorate further against Brent.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings