Last week's CBR decision to cut the key rate by 50bp to 11.0% clearly added to the vulnerability of the RUB and looks increasingly like a mistake. However, there does not appear to be overshooting yet and, if oil price and the RUB appreciate from here, the impact on inflation will be moderate.

"We would expect the CBR to deliver another 100bp in rate cuts the next three months - compared with current market pricing of about 64bp (using 3m MosPrime adjusted for the basis)," notes Barclays.

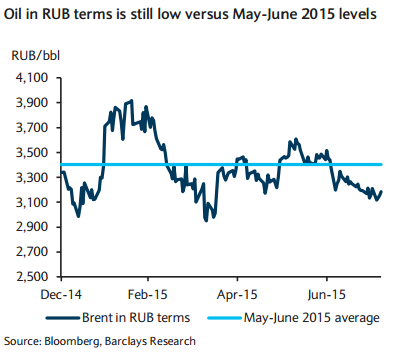

If oil prices remain at low levels, there is greater scope for the RUB to depreciate from current levels (eg, a further 5-10% depreciation of the RUB is needed to bring Brent in RUB terms back to levels prevalent in May-June 2015). The CBR may attempt to smooth these FX moves and avoid overshooting by tightening monetary conditions, either by offering more in FX swaps or decreasing liquidity in its RUB auctions. The risks are that the CBR will cut less than the forecasts and more in line with the market.

Falling oil keeps RUB under pressure, monetary policy doesn't help

Friday, August 7, 2015 12:40 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed