Fetch.ai is developing a platform to help the development of an AI-enabled decentralized digital economy. AI Agents are programs that can make choices on their own for individuals, companies, and devices. Agents are the actors and the heart of the Fetch.ai ecosystem.

Fetch.ai is made up of four key layers: AI Agents, Agentverse, AI Engine, and Fetch network.

AI agents- AI Agents are programs that can interact autonomously with other agents in a decentralized environment. These agents are the basic building blocks that allow developers to gain access to the tools and resources provided by the urgent Framework.

They provide a gateway to a future where intelligent agents, are empowered by the Fetch network and AI engine.

Agentverse- The Agentverse is an intuitive platform designed for creating, testing, and deploying customizable AI Agents. The Agentverse (opens in a new tab) includes a cloud-based IDE for the development and deployment of AI agents.

It is an easy-to-use platform that provides users with a straightforward graphical user interface that makes it easy to create and use agents of any kind.

The AI Engine is a system that combines AI Agents with human-readable text input to create a scalable AI infrastructure that supports Large Language Models (LLMs). It is at the heart of DeltaV and its functionalities.

DeltaV works as an AI-based chat interface. DeltaV acts as a front-end interface to the AI Engine, enabling a simple chat interface through which users can enter their requests, which are then translated by the AI Engine into a series of tasks to be performed.

Fetch network-

The Fetch.ai (FET) token is the utility token and the key medium of exchange on the Fetch.ai network. FET can be used to pay for services in the Fetch ecosystem and network transaction fees.

The Fetch.ai team initially developed the FET utility token on an ERC-20 contract on the Ethereum network.

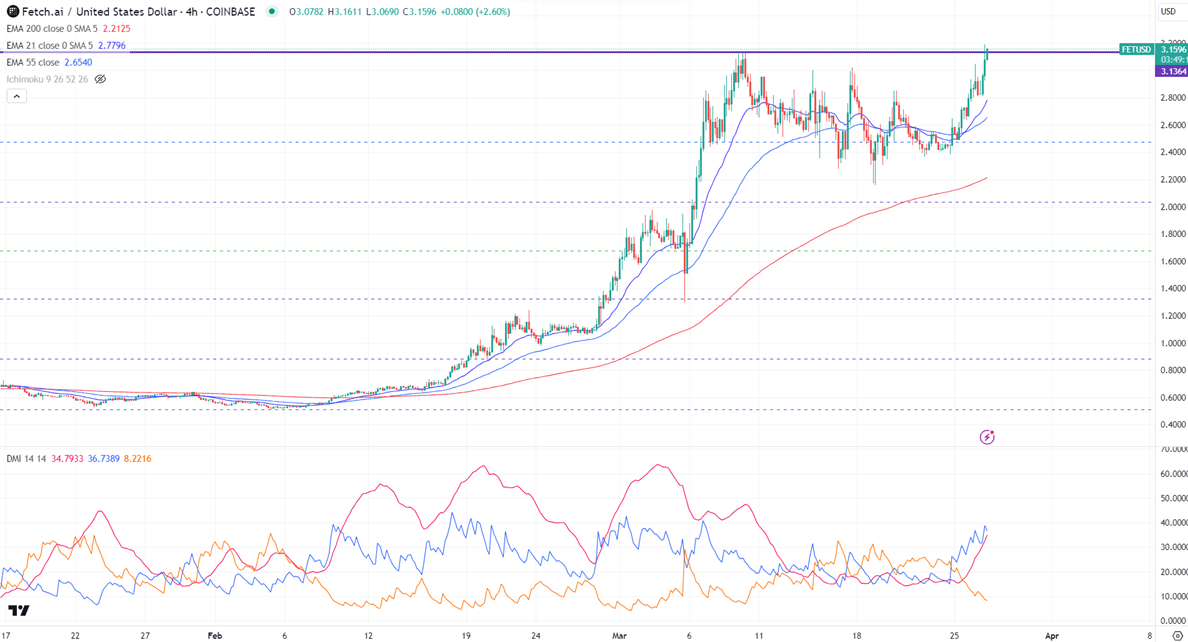

FETCHUSD surged more than 45% in the past one week. It holds above the short-term (21 and 55 EMA) and above the long-term moving average. It hit a high of $3.18 and is currently trading around $3.115.

The bullish invalidation can happen if the pair closes below $2. On the lower side, the near-term support is $2.63. Any break below targets $2.45/$2. Any breach below $2 targets $1.29/$1

The pair's near-term resistance is around $3.25. Any breach above confirms minor bullishness. A jump to $4 is possible. A surge past $4 will take it to $5.

.

It is good to buy on dips around $2.65 with SL around $2.20 for TP of $4.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential