More uncertainty “What Mr Trump was saying and doing revealed a character and temperament unfit for the leader of the free world,” Mitt Romney, 28 May, Wall St Journal above and beyond concerns about the specific policies that the potential president Trump might put in place.

EM currencies could react to the uncertainty over these policies – and candidate Trump’s track record for changing his mind.

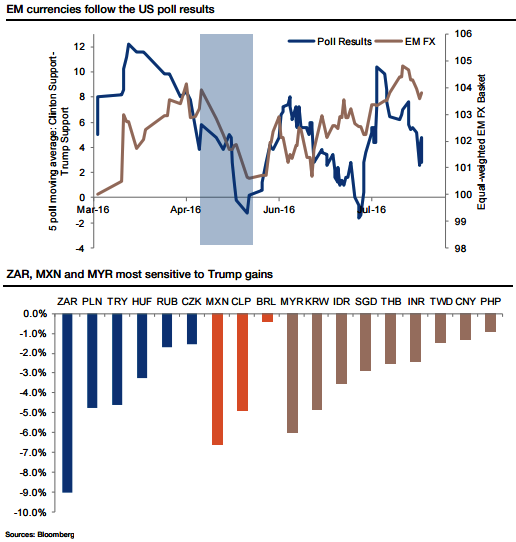

This, in turn, could provoke a general slide in EM currencies, and the worst hits are likely to be those with the highest beta.

While beta does shift over time, the above graph demonstrates the correlation coefficient between various currencies and a basket of EM currencies weighted equally by region.

Unsurprisingly, the ZAR, RUB, and BRL all have high betas, while the pegged CNY and South East Asian currencies have low betas.

It is the US political uncertainty (alongside Chinese and EU uncertainty) that matters most for EM currencies, not their own local uncertainty indices. And both isolationist and protectionist tendencies would add to such uncertainty under the potential presidency of Trump.

Statements like – “I'm going to tell our NAFTA partners that I intend to immediately renegotiate the terms of that agreement to get a better deal for our workers.” – Donald Trump, 28 June (Reuters).

“I want to keep NATO, but I want them to pay…I don’t want to be taken advantage of … We’re protecting countries that most of the people in this room have never even heard of …” – Donald Trump, 27 July (The Guardian), are the instances of isolationist and protectionist tones.

By contrast, some regions could benefit from such a shift. Russia, for example, could gain from fewer US sanctions and could see increased Russian arms sales.

Stay Short in USDZAR: Current spot ref. at 14.4098, contemplating above political turbulence we recommend USDZAR shorts but with positional trades using diagonal credit put spreads (DCPS), strikes at 1w/1m 14.7516/13.67 targeting 10% move lower to 12.8749 in medium terms. We place a stop-loss 3-4% higher than current levels at 15.0434.

Long USDRUB 1w debit put spread (63, 60.10), spot ref: 62.58.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand