On intraday charts, hammer pattern candlestick formed at 91.47 levels on declines. A hammer appears on a downtrend at or near the bottom which suggests that the market is hammering out a base.

Slow stochastic suggest oversold pressure as %D line crossover formed below 20 level. (%D line at 9.2076 & %K line at 8.6436).

As the pair is trading near lower Bollinger band at 91.3413 levels and prices are considered to be oversold if they touch the lower band, Rising prices are confirmed with the substantial volumes but not on falling side.

So please be advised that on speculation basis for an intraday trading perspective we recommend buying binary call options for targets at 91.55 and even at 91.60 levels.

On hedging grounds, we are advocating bear put spreads to arrest downside risks as the major trend seems to be downtrend.

On weekly chart oscillators suggest downward convergence with the falling prices. RSI (14) converges price slumps at 48.4391. While stochastic shows %D line crossover but not significant though yet above 20 levels.

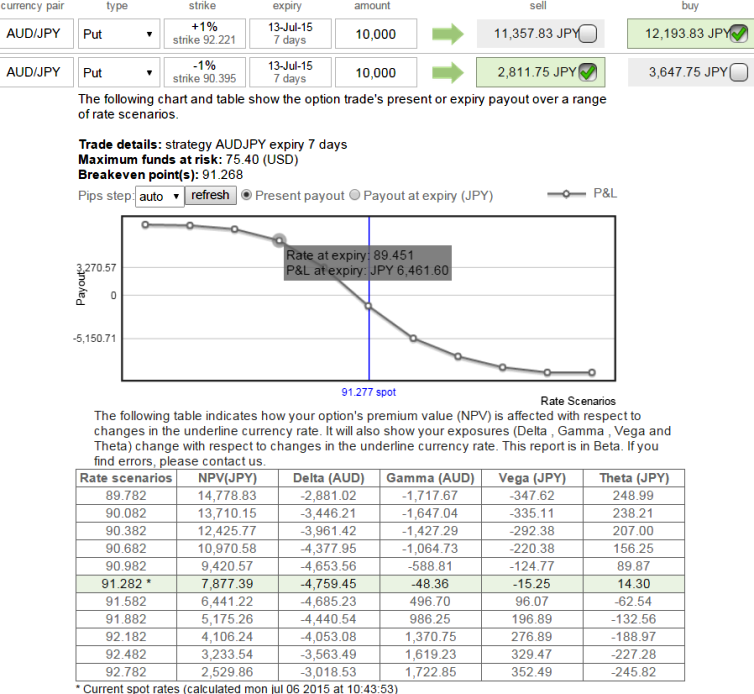

With a view being bearish bias we recommend buying 7D (1%) In-The-Money 0.74 delta put option while sell 7D (-1%) Out-Of-The-Money put options for a net debit (something like USD 9391.83 as shown in the diagram).

FxWirePro: Buy AUD/JPY binary calls for speculating; put spreads for hedging

Monday, July 6, 2015 5:56 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings