Crude Derivatives Insights:

Although the major trend being downtrend, today we may expect little recovery in crude prices, we advise to use this as a means of swing trading with the help of WTI binary delta calls for a targets of 57.40-50.

Since the technical factors are bearish bias on this commodity, on hedging grounds we are recommending buying WTI oil put back-spread (2:1) so as to extract leverage and participate in prevailing downtrend & derive highest profitability.

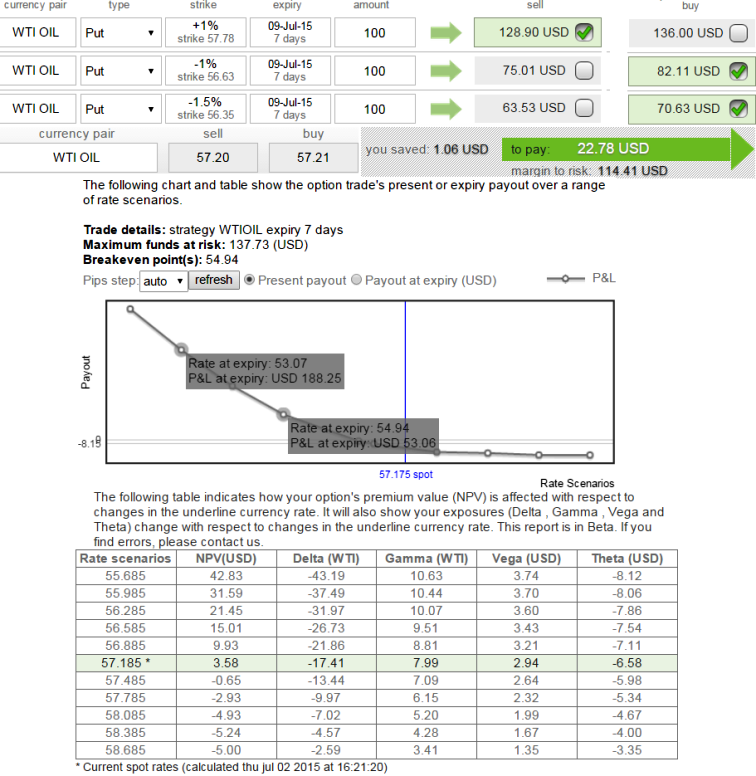

Sell 7D (+1%) In-the-Money WTI oil put option and simultaneously buy 15D (-1%) Out-Of-The-Money delta WTI oil put option and 15D (-1.5%) Deep Out-Of-The-Money delta WTI oil put option.

It is an unlimited profit on downside, limited risk to the extent of net units on short sides.

This strategy is advised when the options trader reckons that the underlying exchange rate will experience significant downside movement in the near term.

The individual instruments and combined position should have option geeks as shown below.

(-1%) OTM put = delta -0.4, vega 3.07

(-1.5%) Deep OTM put = delta -0.35, vega 2.97

Combined - delta -0.17, vega at close to 3.0.

FxWirePro: Buy WTI oil binary calls for targets at 57.40; but PRBS hedges potential downtrend

Thursday, July 2, 2015 11:02 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?