Lot of puzzling has been happening in CADJPY when we consider the intermediate and long term trend of this pair.

Bullish candles such as dragonfly doji at 92.207 on weekly has been able to prop up prices effectively as the bulls have shown clear buying interest to substantiate the leading indicators on monthly and weekly charts are converging the current upswings that would still suggest the previous downtrend trend to reverse a little.

Earlier, several times it has managed to take supports at 88.910 levels (see green colored circle areas) which means appearing dragon fly at this juncture has shown us a great strength with reasonable currency valuations at this level.

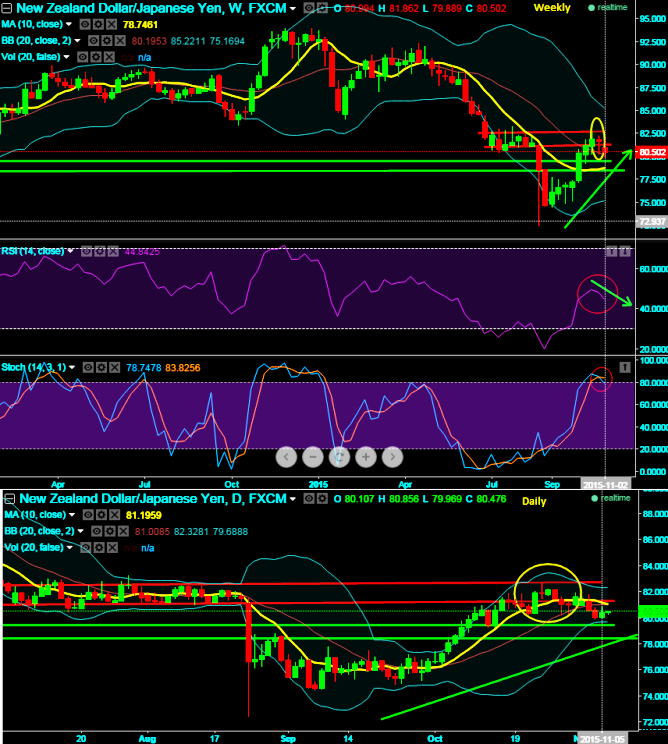

Weekly RSI has started converging with price spikes near 45 levels (Currently, RSI at 43.0275)

But slow stochastic is stating indecisiveness as we observed no clear traces of %K crossover at 20 levels on monthly terms that would mean buying pressure is yet generate at this point of time.

The current prices on both daily and weekly charts remained well above 10DMA curve. So this week's closing figures would give us clear picture for next uptrend of this pair in long term.

Trading tips: Contemplating intraday bull sentiments, we recommend on pure speculation basis buying one touch binary calls in order to extract maximum leverage for extended profitability, for targets at 92.975 with SL at 92.250. But in medium terms we could even foresee spot targets at 93.250 areas.

By employing At-The-Money binary delta calls one can multiply returns by twice, thrice or even pour returns exponentially. But do remember these are exclusively for speculative basis.

FxWirePro: CAD/JPY testing resistance at 92.650 – rosy options for swing traders, binary calls for TP at 92.975

Friday, November 6, 2015 7:08 AM UTC

Editor's Picks

- Market Data

Most Popular