Lot of puzzling has been happening in CADJPY when we consider the intermediate and long term trend of this pair.

Bullish candles such as dragonfly doji at 92.207 on weekly has been able to prop up prices effectively as the bulls have shown clear buying interest to substantiate the leading indicators on monthly and weekly charts are converging the current upswings that would still suggest the previous downtrend trend to reverse a little.

As stated in our earlier post, the time for Yen holding tight back again, all chances of Yen may look superior over Canadian dollar in medium term future but no dramatic differences in prices on either direction, thus we advise to hedge this pair with below recommendations.

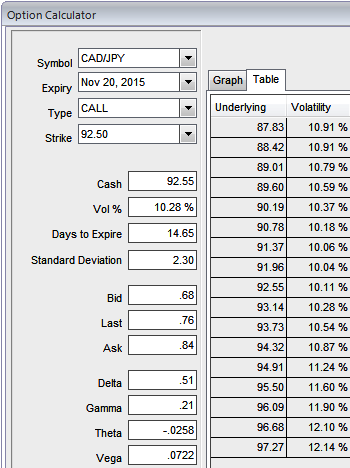

Currently the pair is trading at 92.560 with volatility of ATM contracts marginally inching higher (at 10.25%), the recent price bounces should not create great deal impetus for strategy. We believe CAD's gain is majorly due to crude's strength.

Hence, the recommendation on buying (1%) OTM 0.15 delta call, while simultaneously shorting an ATM call with similar expiries and buy another (1%) ITM 0.80 delta call while simultaneously shorting another ATM put with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as CADJPY is perceived to have a low volatility.

Please be noted that the highest return for this strategy is achievable when the pair at expiration is equal to the strike price at which at the money options are sold. At this price, all the options expire worthless and the options trader gets to keep the entire net credit received when entering the trade as profit.

FxWirePro: Construct butterfly spreads with calls to hedge CAD/JPY puzzling swings

Friday, November 6, 2015 8:36 AM UTC

Editor's Picks

- Market Data

Most Popular