GBPAUD has gained almost 1.29% so far in this month, the pair has continued yesterday’s marginal gains from 1.8080 to the current 1.8192 levels.

We have turned modestly positive in GBP through 2021. But the Aussie’s support is broader than equities however, with commodity prices accelerating in recent weeks, especially iron ore and copper. We see a gradual appreciation path for the currency, with GBPAUD ending this year at 1. 7175 before heading to 2.08 by end H1-2021.

BoE and RBA are scheduled for their monetary policies for the next, the combination of the RBA's liquidity injections, asset purchases and Term Funding Facility has dampened volatility out to 3 years.

On the flip side, BoE is most likely to maintain status quo, but we also heard from the BoE’s Haskel who voted with the majority for a further increase in the asset purchases at the BoE’s last policy meeting. However, he was ahead of the pack in suggesting such an increase at the previous meeting and is generally considered to be one of the most dovish members of the Committee.

Hence, contemplating the puzzling swings ahead of the monetary policy events, we’ve advocated below options strategies to arrest both bullish and bearish risks as per the minor and the major trends.

Hedging Framework (3-Way Diagonal Options Spread):

Ratio: (Long 1: Long 1: Short 1)

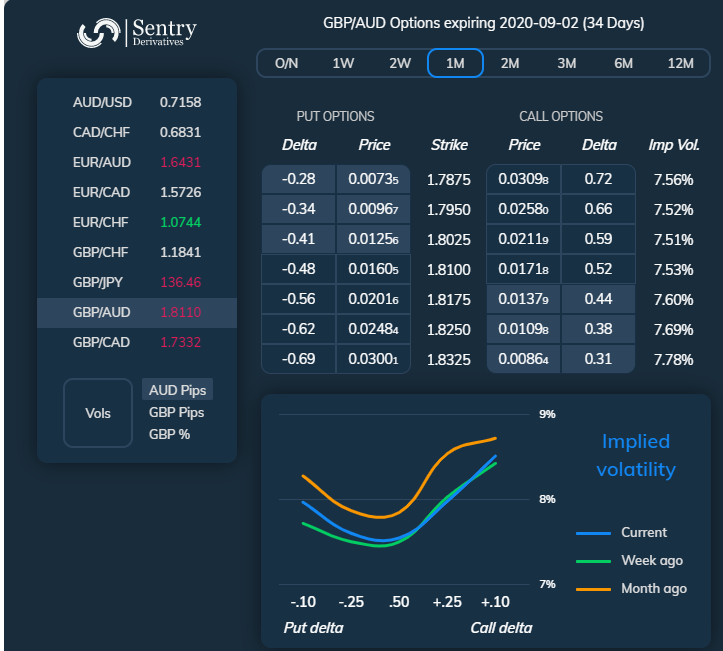

The execution: Initiate long in GBPAUD 3m at the money delta call, long 6m at the money delta put and simultaneously, Short theta in 1m (+1.5%) out of the money put with positive theta or closer to zero (spot reference: 1.8193 level).

Rationale: Contemplating 3m IV skews that are well balanced on either side (positively skews on both OTM calls and OTM puts), we reckon that the Delta instruments are conducive to monitor directional risk so as to be aware that how much of option’s value would increase or diminish as the underlying market moves as this option tool measures the value of an option as the underlying spot FX moves.

We reiterate, in the prevailing puzzled environment you could observe that the momentary bulls of GBPAUD has currently been trading in the intermediate bearish trend. Hence, we advocate the above hedging strategy with cost-effectiveness that could hedge regardless of the swings on either side. Courtesy: JPM & Sentry

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts