The corporate bonds in emerging market continue to outperform DM equivalents. However the supply advantage is fading, and currency movements are not big enough to justify the spread tightening. We still see EM corporate as an asset class to avoid.

For an instance, In EMEA, the Turkey rates have moved lower the most this week within EMEA. The long Turkey bond trade has worked well on falling yield, although the currency has not favoured the position yet.

In Asia, we entered into 2Y SGDUSD payer before of FOMC meeting and the trade benefits if the market prices in higher expectations of a Fed rate rise in December. FX is an additional factor potentially driving SGD rates higher, which tend to rise when SGD weakens.

In Latam, the TIIE curve is biased to flattening ahead of the Banxico meeting next week on increased risk of a risk rate as bi-weekly CPI was higher than expected and MXN depreciated sharply.

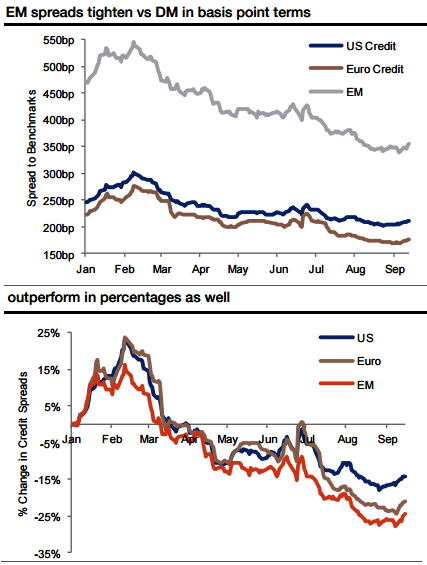

The EM corporate bond rally continues. Although spreads gave up a bit of ground this week, they are some 125bp tighter than they were at the start of the year, and 200bp below the peak levels reached in February.

In EMEA, we like long in PLNHUF premised on overdone bearishness regarding Poland’s political backdrop and understated EU-Hungary tensions, as well as real yield support, although the S&P raised Hungary credit rating to investment grade.

In Asia, the INR FX forward points should move down as the counterparties to the RBI’s long forward positions will likely create additional demand for the USD, given FCNR payments over the next quarter.

We highlight several dislocations in EM baskets, and would recommend buying MXNCLP, MYRKRW, TRYZAR, CZKHUF and selling BRLMXN.

DM spreads have tightened only half as much. This is not just a beta effect either, the above chart shows, the percentage tightening has been bigger in emerging market corporate than in developed market corporate.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook