FxWirePro: EUR/CHF delta risk reversal suggests expensive hedging costs but offers good trading opportunities, IV and technicals to boost trading view

Thursday, August 6, 2015 9:48 AM UTC

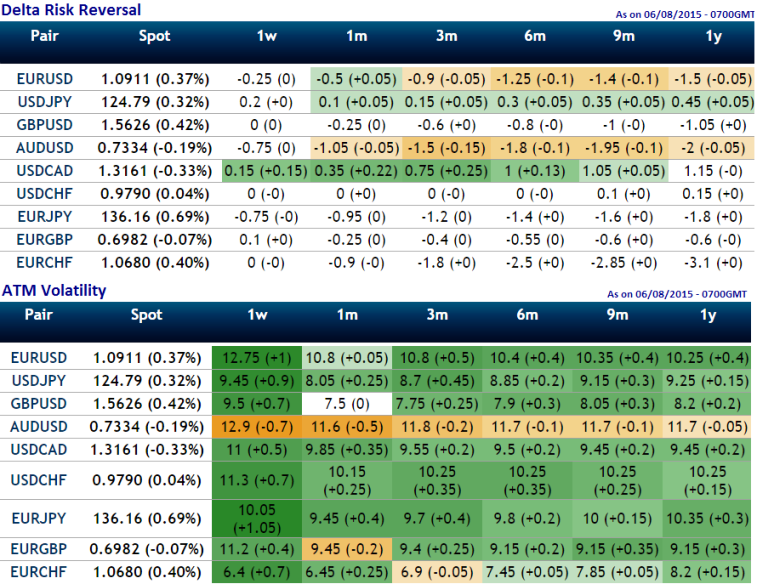

- Delta risk reversals of EURCHF for next 6 months: EURCHF bid for calls distorted after the temporary resolution of Greece issue helped by a similar move in other EUR crosses and are currently hovering near the post-crisis lows. After the move to 1.0593, the OTC options market appeaed to be more balanced on the direction for the pair over the 1m to 1y time horizon and as a result delta risk reversal for EURCHF was turning into negative.

- From the nutshell, 25-delta risk of reversals of EUR/CHF the most expensive pair to be hedged for downside risks as it indicates puts have been over priced. As it showed the highest negative values indicate puts are more expensive than calls (downside protection is relatively more expensive).

- ATM volatility: While IV is also perceived to be least among major currency ATM pools in the OTC market. So the active traders can speculate prices freely in until next 6 months timeframe. Lower volatility is good for bulls because if any abrupt disruption arises in EURCHF then the low IV implies the market thinks the price will not dip much.

- Technicals: RSI (14) on weekly is pretty much positive for bulls as it is positively converging with rising prices, while slow stochastic curve reached overbought zone though, clear indication has not been traced out but more buying interest seen.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?