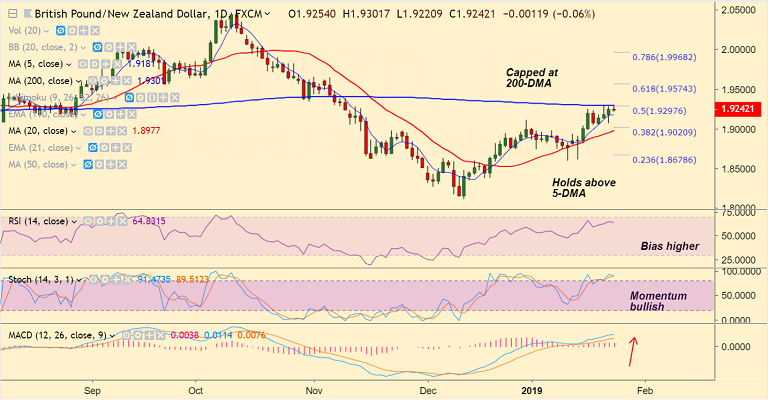

GBP/NZD chart on Trading View used for analysis

- GBP/NZD is trading in a narrow range, with session highs at 1.93 and low at 1.9220.

- Technical studies are highly bullish, but upside is being capped at 200-DMA at 1.9301.

- We expect some consolidation at current levels. Breakout at 200-DMA could see further upside.

- Next major resistance above 200-DMA lies at 61.8% Fib at 1.9574.

- Brexit optimism is supporting the Sterling, but political uncertainty will at some stage, cap the rally in GBP.

- The pair is holding support at 5-DMA. Break below could see dip till 20-DMA.

Support levels - 1.9178 (5-DMA), 1.9020 (38.2% Fib)

Resistance levels - 1.9301 (200-DMA), 1.9574 (61.8% Fib)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.