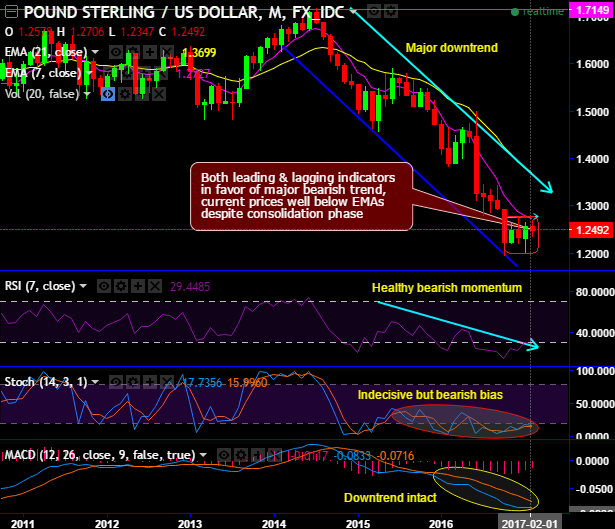

Following another test of 1.2400-1.2345 support, GBPUSD rallied sharply yesterday afternoon to retrace the post-retail sales decline. On the flip side, from last three and a half months, the underlying pair is stuck in the range of 1.2775 and 1.1987 levels.

This places us firmly back in the middle of the interim 1.2350-1.2600 range, itself within the 1.1980-1.28/1.30 range. Momentum studies are also back at mid-range levels. We watch 1.2410-1.2380 support. A break would open 1.2350 and 1.2250. A rally up through 1.2500/70 resistance is needed to suggest a broader move back to range highs.

Long term, we believe the decline that started back in 2007 at 2.1160 is close to completing with the move under 1.30. While it is unclear that 1.1491 was the major base, 1.15-1.08 is our ideal ultra-long term basing region.

GBP put/USD call digitals: GBP put/USD call digital prices, while not at absolute post-Brexit lows, are less expensive than at many points over the past year (refer above chart).

For instance, 5% OTMS cable put digitals offer maximum gearing of nearly 5 times, in the upper-end of the historical range of the past year since the Brexit referendum entered the market's consciousness as a risk event to reckon with.

9M -1Y 1.15 strike GBP put/USD call at-expiry digitals for instance cost in the vicinity of 16%-17% (mid, spot ref. 1.2563), which is a shade below the realized frequency of annual 5% -10% GBP spot declines over the past 20-years.

The inference is that there is little risk premium in option prices for the possibility of a material drop in sterling that could materialize in the event of a disorderly Brexit; at the very least, anxiety about such an eventuality is nowhere near post-referendum highs and not particularly elevated relative to historical spot outcomes.

Digital options also offer a friendly decay profile and are suitable to hold through a long drawn Article 50 process that will play out over a period of months.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate