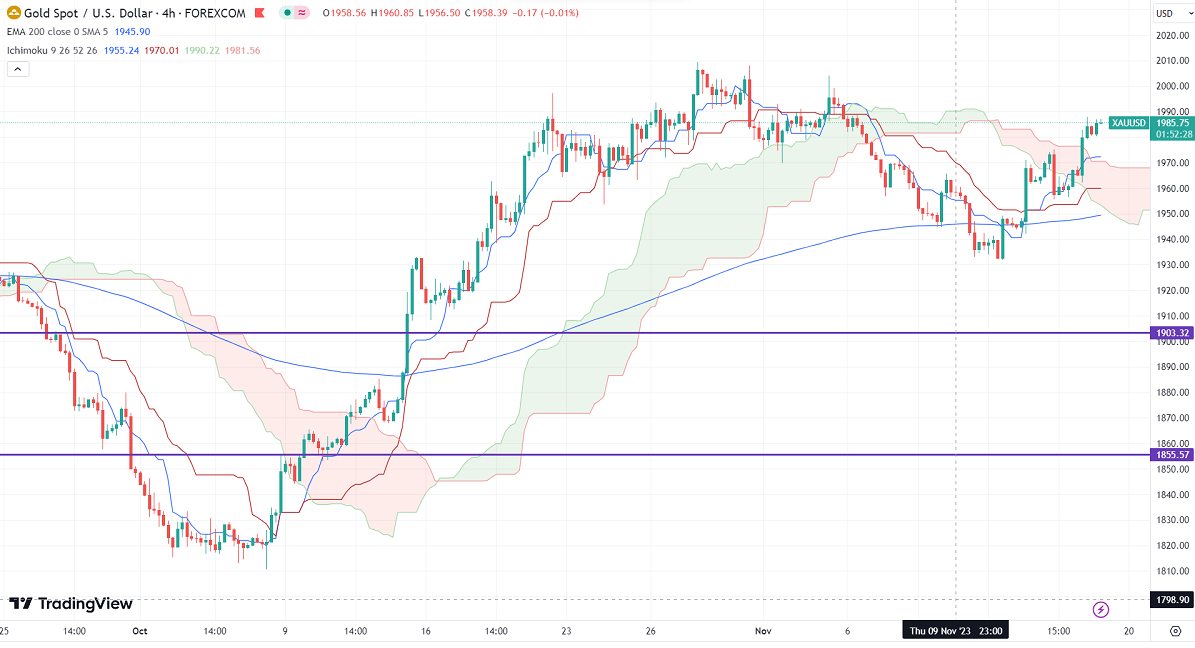

Ichimoku Analysis (4 hour chart)

Tenken-Sen- $1972.28

Kijun-Sen- $1959.90

Gold surged more than $30 on the weak US dollar. It hit a high of $1988.03 and is currently trading around $1986.25.

Former Kanas City Fed CEO and President Esther George said that "the Federal Reserve does have time to pause here".

The number of people who have filed for jobless benefits increased by 13000 in the week ending November 11th to 231000, compared to a forecast of 218000.

US dollar index- Neutral. Minor support around 104/103. The near-term resistance is 106.25/107.50.

According to the CME Fed watch tool, the probability of a no-rate hike increased to 99.8% from 85.40% a week ago.

The US 10-year yield lost its shine on hopes of a rate pause by the Fed. The US 10 and 2-year spread widened to -40% from -16%.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Weak (positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1950, a break below targets of $1929/$1900/$1850. The yellow metal faces minor resistance around $1975 and a breach above will take it to the next level of $1990/$2000.

It is good to buy on dips around $1970 with SL around $1958 for TP of $2000/$2009.