FxWirePro- Gold Weekly Outlook

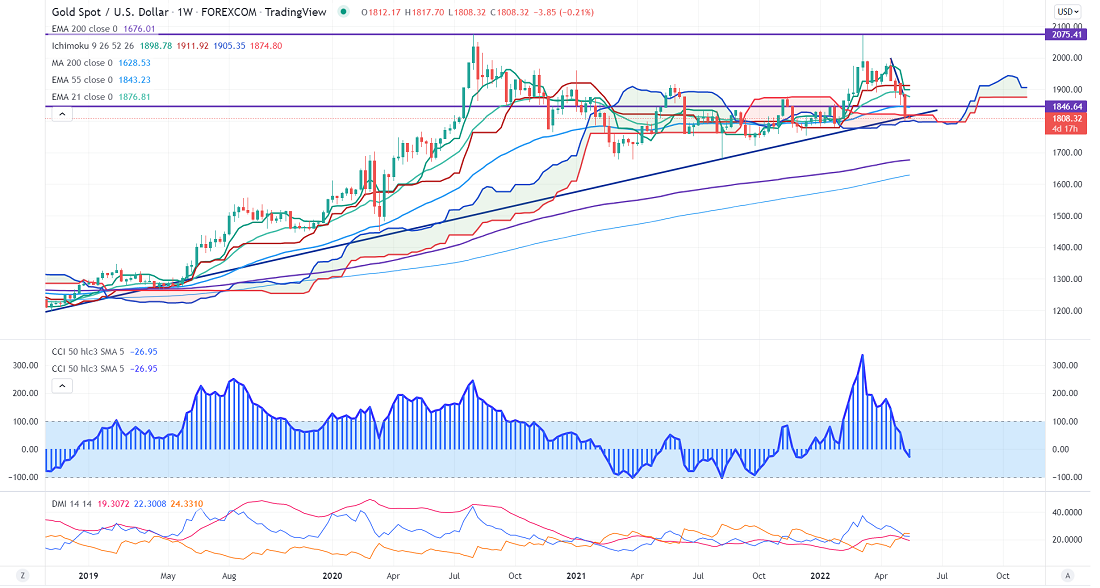

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- $1898.78

Kijun-Sen- $1911.79

Gold showed a massive sell-off of more than $100 on the strong US dollar. It hits near a 20-year high in hopes of aggressive rate hikes by the Fed. It hits an intraday low of $1799 and is currently trading around $1809.65.

US CPI cools off to 8.3% from March's 40-year high of 8.5%. The inflation is better than the forecast of 8.1%The number of people who have filed for unemployment benefits rose by 1000 last week to 203000 compared to a forecast of 190000. US Producer price cools off to 11% in Apr over the past year compared to a previous month of 11.5% on declining crude oil prices

Factors to watch for gold price action-

Global stock market- bearish (positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1800, a breach below targets $1750. Significant reversal only below $1750. A dip to $1700/$1689 is possible. The yellow metal faces strong resistance of $1836, any breach above will take to the next level $1850/$1862/$1880.

It is good to sell on rallies around $1828-30 with SL around $1860 for TP of $1750/$1700.