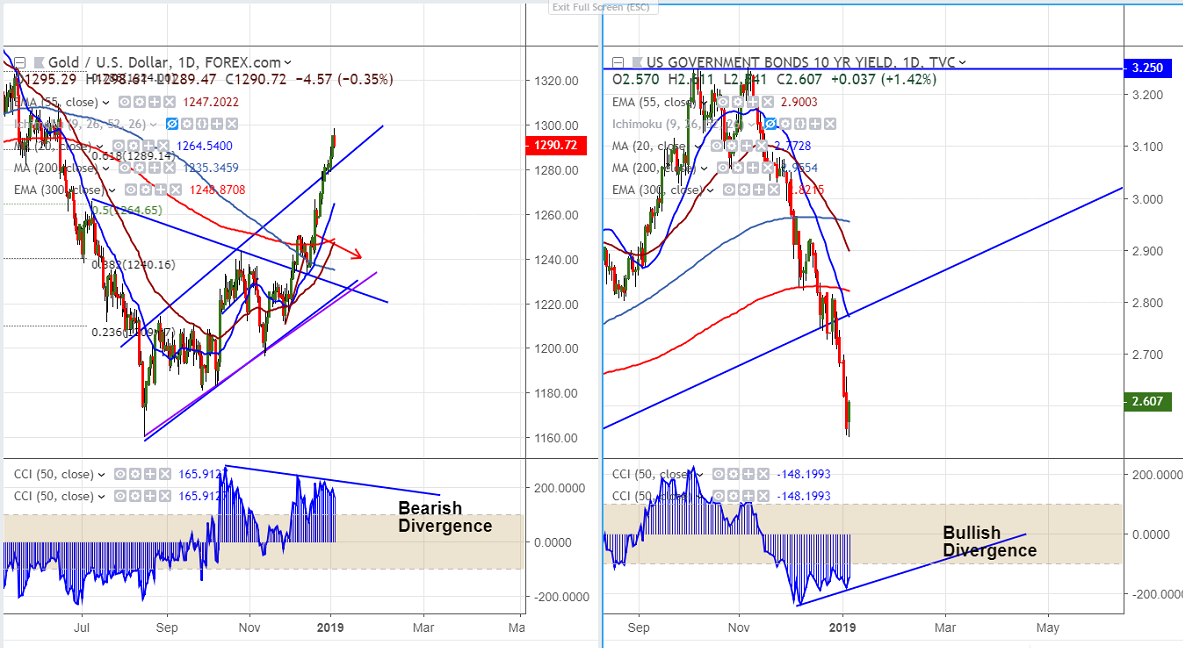

Chart pattern formed- Gold (Bearish divergence)

US 10 Year yield- Bullish Divergence

Gold was trading higher for past one month and has jumped more than $70 from the low. The yellow metal is in over bought and slight dip till $1270/$1260 is possible.

US 10 year yield was trading weak for past two months and lost more than 22% from high of 3.25%. It has halted its major weakness at 2.54% (Double bottom).

It is good to sell gold on rallies around $1295 with SL around $1301 for the TP of $1270.