For traders who think euro began to find its strength against dollar but its sustenance seems skeptic as macro numbers getting softened along with tempaorarily resolved Greece matters on euro side in near terms but Fed's big event on the flip side on medium to long terms, using put backspreads can mint money by speculating.

Here are the ways in which one can build put ratio back spread regardless of swings. Those In-The-Money puts on short side in put ratio backspreads are always at risk of exercise, but you have two advantages.

Firstly, keeping maximum tenor on long side: Giving a longer time to expiration for long sides so as to make a substantial move on the downside so that assignment can be covered by the long puts.

Secondly, time decay advantage: Using near month contracts or contracts shorter tenor on short side signifies the importance of entering the position when IV is lower than average. Time decay and implied volatility work in your favor on the short puts.

The typical position combines buying at-the-money or out-of-the-money puts and, at the same time, selling a smaller number of in-the-money puts. We recommend arresting further downside risks of this pair in medium to long term time frame as the Fed's decision is in September. Expect the underlying currencies EURUSD in this case to make a large move on the downside.

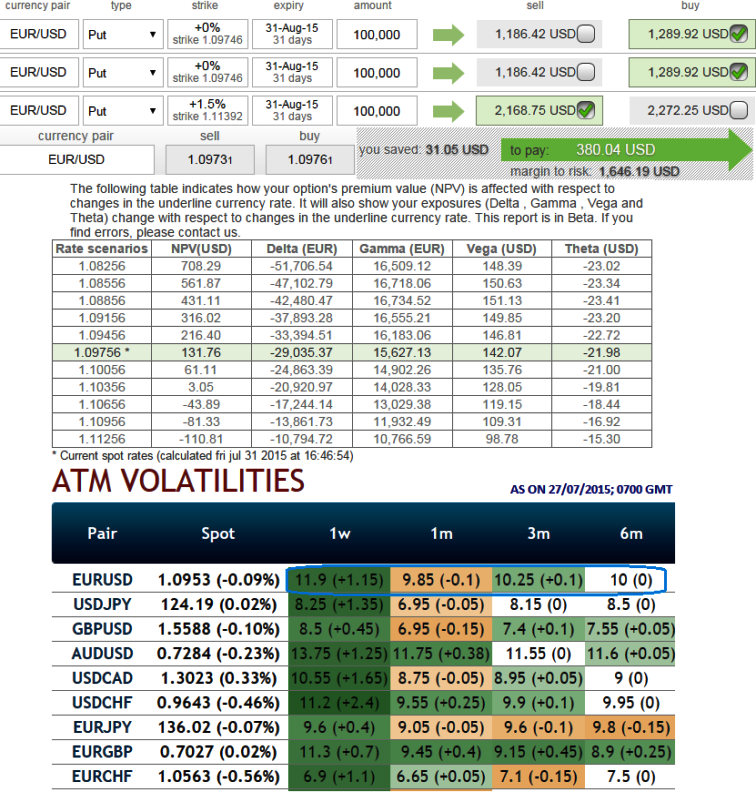

Hence, as shown in the figure purchase 1M 2 lots of At-The-Money -0.48 delta puts and sell 15D one lot of (1.5%) In-The-Money put option usually in the ratio of 2:1 (for demonstration purpose only we've used maturity as 1 month on both sides). The combined vega at 142 indicates better chances of delta being sentitive towards IV (Ref: ATM IV nutshell, where EURUSD has perceived 2nd highest IV after AUDUSD).

FxWirePro: Improving odds with EUR/USD put backspreads creates speculating opportunities too

Friday, July 31, 2015 11:27 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings