GBP OTC hedging sentiments are intensifying due to the Brexit negotiations in Brussels – and the EURGBP exchange rate is trading above the 0.92 mark. Is this the beginning of a significant collapse of the British currency? Not yet, but the risks are rising.

Even if was never our central scenario we have always pointed out the risk of further notable Sterling depreciation.

In our view, the reason behind this risk is the country’s high current account deficit (almost £17bn. in Q1/2017 alone). This deficit has to be financed with the help of capital imports. In a situation such as this depreciation expectations can turn into a self-fulfilling prophecy if the capital inflow is reduced, the currency depreciates and these concerns fuel themselves. So far this has not been the case.

The Brexit referendum did lead to notable Sterling depreciation which led to a notable reduction of the current account deficit without such a self-propelling process taking shape.

However, the risks for the British currency are far from over. The current account deficit remains considerable and above all: the Brexit negotiations between the British government and the EU are difficult - to put it mildly. So far the market participants seem to be putting up with this in view of the fact that there is still plenty of time for the negotiations.

GBP OTC markets buzz with bearish hedging sentiments:

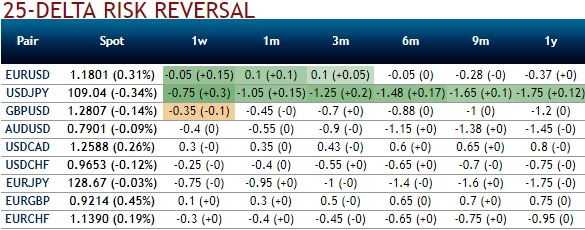

Please note that the nutshell showing the shift in delta risk reversals of GBP has been indicating downside risks in the weeks to come.

IVs have been stable with positively skewness for OTM put strikes that signify the hedgers’ bearish interests.

Mounting negative delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Hence, we advocate weighing up above aspects by eyeing on loading up with fresh delta longs for long term hedging in option spread strategies, more number of longs comprising of ATM instruments and OTM shorts in short term would optimize the strategy.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure