In Canada, official data showed that manufacturing sales increased by 1.0% in April, beating expectations for an uptick of 0.6%, after a 0.9% fall the previous month.

On an expected stabilization then rebound in crude oil prices and better performance in the non-resource sector.

The benefits of a weaker CAD are expected to present a boost to growth via exports and there are signs that the most exchange rate sensitive sectors are already performing well.

The loonie lower against the euro, with EURCAD pairing 0.25% to 1.4458.

The commodity-driven CAD was also under stress amid declining crude price due to mounting concerns over a Britain's potential exit from the European Union and a surprise rise in U.S. inventories.

We look for the BoC to begin tightening monetary policy in Q3 & Q4 of 2016.

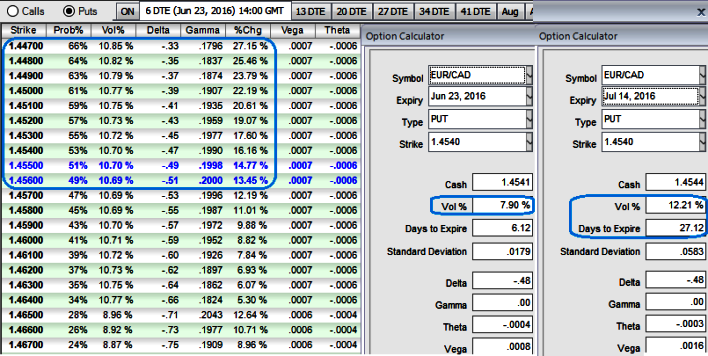

1w ATM IVs of EURCAD is tad below 8%, and likely to spike above 12% in 1m tenor.

A 2:1 put ratio spread can be implemented by buying a number of puts at a higher strike and selling twice the number of puts at a lower strike.

The put ratio spread is a neutral strategy in options trading that involves buying a number of puts and selling more put options of the same expiration date at a different strike price.

It is a limited profit, an unlimited risk options trading strategy that is taken when the options trader thinks that the underlying spot FX would experience little volatility in the near term.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate