The dollar tended to strengthen in the past few rounds of trade tensions; however, at this juncture dollar has been falling like a stone although the US-China relations are sour. Putting this into CNY's perspective, this will translate into a somewhat lesser depreciation pressure versus USD, while the sentiment might still drive the Chinese currency to the weak side. As a result, CNY will depreciate more against non-USD currencies, such as EUR. For those operating in China while importing machines from Germany, this is certainly not a piece of good news. However, for the Chinese authorities, this might create a "sweet spot" for them - They don't need to worry about capital outflows that could be triggered by expectations of large depreciation, and a relatively weak currency would benefit the export sector which actually employ millions of workers. All told, there seems no directional trend for the CNY.

As a RV construct, long CNH options vs. short TWD options in any form is on the right side of the beta divide in Asian FX. For Asian currency investors, the salutary lesson of the past three years since the US – China trade conflict erupted is that there is no higher beta RMB proxy in the region than the RMB itself, not even traditional cyclically sensitive candidates like KRW whose risk elasticity has declined markedly in recent times. USDTWD options, particularly USD calls/TWD puts, have been popularly deployed as a lower beta but better yielding North Asian proxy for CNY weakness, but for the most part, aggressive spot moves have been frustrated in both directions by a mix of fundamentally positive currency

macro (large NIIP, large C/A surplus, lifer and exporter hedging) on the upside and CBC smoothing on the downside. The latter has become particularly notable of

late, in the context of the TWD NEER persistently hugging the upper-end of the so-called dynamic stability corridor (36-month MA +/- 5%) that the central bank closely monitors as a gauge of currency valuation, and has shrunk close-to-close 1-mo realized vol of TWD 1M NDFs from 5.0 in late May to 2.0 currently, vs. 3.3 for CNH on a similar measure. In this context, it is interesting that the USDCNH vs USDTWD ATM vol spread in sub-3M tenors had shrunk to almost zero earlier in the week before the tit-for-tat consulate closure brouhaha gave front-end CNH vols a sharp lift. Unlike the heavily managed TWD, CNH is currently a currency on the move, and is perhaps the most heavily owned Asian FX by the spec community

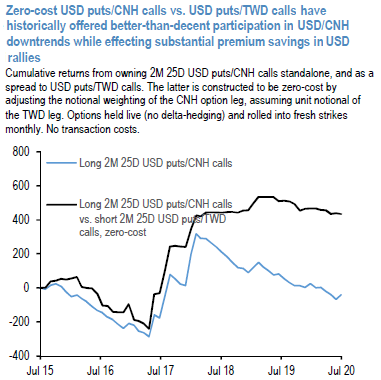

in anticipation of growth / rates / BoP-driven fundamentally justified currency strength. Owning USDCNH puts financed with USDTWD puts is a premium efficient way of positioning for conditional USD weakness – conditional because both options stand to expire worthless and leave no P/L trace if constructed in zero-cost format should an intensification of US – China tensions lead to an abrupt and material weakening of the Asian FX complex. Exhibit 9 shows that such option spreads have an impressive track record of participating in

USD weakness in recent years without commensurate exposure disruptive USD strength. Despite the sharp spike in implied vols, current pricing on a USD put/CNH call vs.

USD put/TWD call option spread still remains attractive given the pronounced forward point carry differential between the two currencies (1M FX implied yield of CNH + 2.4%, TWD -4.2%) that permits asymmetric strike locations on the two legs (e.g. 3M 1% OTMS USDCNH puts can be costlessly financed with 3M 2% OTMS USDTWD puts). And from the standpoint of a directional RV, the disturbance of relative vol optimality on account of the late-week jump in CNH vol is more than compensated for by the more attractive re-entry location on spot.

Initiated long 2M 1% OTMS USD put/CNH call vs. short 1M 1.75% OTMS USD put/TWD call @ zero cost. Both legs held live (no delta-hedging). Courtesy: JPM

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand