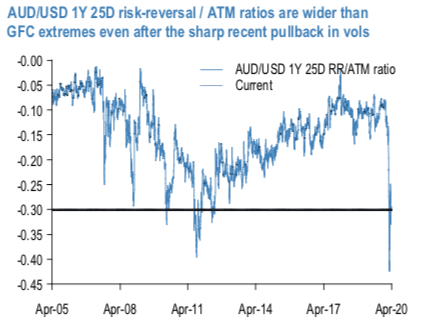

Even after the 50% pullback from the manic extremes of March, AUDUSD risk-reversals are at 2008 GFC extremes as a ratio to ATM vols (refer above chart). The short-memory of the unhinged collapse in AUD spot and spike in AUD vol in March likely has everything to do with this extreme pricing, since realized spot-vol correlation has halved from YTD wides (trailing 30-day % spot vs. 1Y ATM corr running at - 40% at present vs. -80% at the 1Q peak) and is clocking below SABR-calibrated spot-vol corr. implied by the 1Y AUD skew (-55%). Risk premium in option prices after a market crash is not uncommon; the oddity in this case is the extreme nature of the distortion, and the persistence of this fear even after broader risk markets have retraced to the extent that they have.

In the recent past, we’ve advised buying delta-hedged AUDUSD 3M ATM vs short 3M 25D AUD put/USD call, 100:150 notional ratio, but EUR call/AUD put ratios may be even more appealing than AUD put / USD call ratios as smile-theta scalping vehicles (usual caveat of liquidity applies) given the re-emergence of European political risk to go with the moderation in AUD negativity. The semi-constructive tone of last week’s Eurogroup meeting and the ongoing run-up in risk markets this week may have taken the edge off immediate anxieties around the North vs. South European divide, but if the Euro and hence EUR-crosses remain quasi-permanently heavy going-forward as the spectre of political risk continue to hang over the common currency, it will prove difficult for EUR/commodity FX or EUR/EM FX risk-reversals to continue reliably delivering enough “upside realized volatility” via explosive spot rallies to justify a sustained premium for EUR calls. Fading the elevated risk premium in the likes of EURAUD riskies – which also neutralizes exposure to the broad dollar and imparts an additional degree of market-neutrality in most conditions (save of course the odd month of explosive liquidation of EUR- funded carry trades) – may therefore prove an even better risk-adjusted bet than selling AUDUSD riskies. Courtesy: JPM

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate