USDKRW remains in an uptrend but has not been able to sustain a move above the 1200 level. The USD trend has stalled since the beginning of 2017.

This move appears to reflect a combination of technical and fundamental factors. Data momentum remains very positive for the region and more broadly for manufacturing in terms of the major economies. This type of backdrop is typically one that benefits the won. We have also seen positive equity inflows year-to-date, with better data momentum and resilient equity market performance supporting factors.

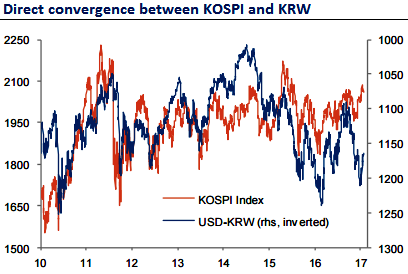

Usually, KOSPI and KRW tend to move together over time (higher KOSPI typically means a stronger KRW and vice versa).

They are linked via risk sentiment and rarely diverge for too long. Based on where the KOSPI is trading, USDKRW should be closer to 1120.

From a fundamental perspective, the KRW is expected to come under additional depreciation pressure in the coming months with a peak around 1240 (similar to that in 2015).

It remains in the cross hairs of higher US yields, protectionism/geopolitics, and China (growth, RMB).

We remain biased toward buying USDKRW but an upward move in global equities that pushes KOSPI higher is a serious risk to our thesis.

Accordingly, we kept advocating appropriate hedging vehicle to keep this upside risk on the check, for now, we still like to maintain longs in USDKRW 1m NDFs, so, go long USDKRW 1m NDF at 1179 with a target at 1245 (+5.3%) and a stop at 1155 (-2.1%). The time horizon is 1-3 months and positive carry is approximately 2bp/month.

Risks factors (US yields, Trump, technicals): Further correction in US yields would benefit the EM FX complex while better growth data and stabilization in RMB would take the edge off the KRW. A tail risk event would be for the US administration to either mention a “weak” dollar policy, or something along the lines of not favoring a “strong dollar” policy. Confirmation of a break in trend line support from the September lows could result in short-term strength.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?