Bullish Scenarios see USDCAD above 1.45 levels if:

1) A second COVID-19 wave catalyses another global sudden-stop and aggravates Canada’s external deficits or

2) The renewed oil price war or demand shock drives additional industry-wide crude production shut-ins.

3) US-China tariff war restarts.

Bearish Scenarios see USDCAD below 1.30 levels if:

1) The COVID recovery is complete (V-shape to 2019 total output).

2) The quicker than expected resolution of the COVID-19 crisis via comprehensive health solution (treatment & vaccine) allowing a quicker economic recovery.

Disproportionately large repatriation by residents helped support Canada’s BoP during the March panic, but external financing vulnerabilities remain a potential drag for CAD, with the ability to attract ongoing inflows impaired post-COVID crisis. Incoming data in the past month shed better light on flows supporting CAD’s relative resilience during the peak of the COVID panic (compared to some other high-beta and petro-FX peers). Recently released March international portfolio flows data show 1.4% of GDP worth of net portfolio inflows in March alone helping offset some of the excess USDCAD demand during the peak of the crisis.

Hence, we make mark-to-market to our USDCAD projections following the recent sizable USD weakness, but maintain an upward bias in the pair to reflect structural CAD headwinds over the 1y forecast horizon. Our near-term USDCAD forecasts are slightly lower than spot to reflect that USD weakness can persist if re-openings around the world continue to contribute a strong pro-growth environment and help buoy risk sentiment. But we believe that the structural drags in Canada will ultimately weigh on CAD over the medium-term, particularly as the local growth story remains bleak from oil and financing the joint C/A-FDI deficit will remain precarious given that Canada no longer enjoys 2019’s best-in-G10 yield advantage. We are also cognizant of longer-term economic forces (quasi-permanent economic scaring associated with dislocations in the labor markets, higher debt levels, the behavioural shifts from consumers and corporates) as well as medium-term risks like fiscal tightening amid an incomplete global recovery by year-end, in addition to tail risks of COVID second waves. As such, we project USDCAD to 1.38 by year-end, and 1.42 by 2Q’21.

Contemplating above factors, we maintain that directionality from here. It makes sense that CAD has focus on Canada's specific weaknesses grows larger.

Hence, add longs in USDCAD via options with diagonal tenors contemplating above fundamental factors and below OTC indications:

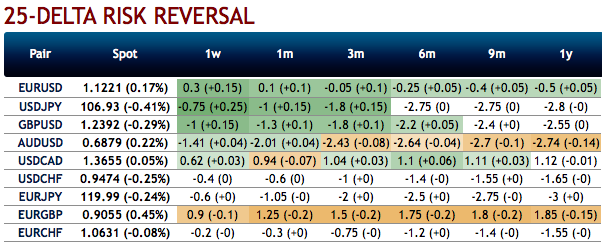

The fresh negative bids for 1m tenor to the existing bullish risk reversal setup indicate the broader hedging sentiments for the upside price risks amid minor hiccups in the shorter tenors (refer 1st chart).

While to substantiate this broader bullish hedging stance, we capitalize on the positively skewed IVs of 3m tenors that indicates the upside risks in in the longer tenors (see bids for OTM call strikes upto 1.41, refer 2nd chart).

Hence, at this juncture (spot reference: 1.3663 levels), we upheld our shorts in CAD on hedging grounds via 3m/1m (1.34/1.41) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CAD recommendations. Courtesy: Sentry, Saxo & JPM

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays